Home / Blog / Celebrating 40 years of Section 125 Cafeteria Plans

Celebrating 40 years of Section 125 Cafeteria Plans

On November 6, 1978, Section 125 was added to the Internal Revenue Code. Congress passed the Revenue Act of 1978, and the Cafeteria Plan was born. To commemorate its 40th birthday, Core Documents presents a series on the sometimes rocky, yet glorious, history of Section 125 Cafeteria Plans.

Section 125 changes to cafeteria plans

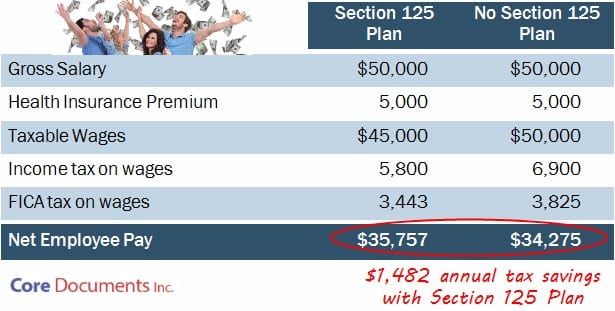

Cafeteria plans existed before 1978, but employer contributions were taxable to employees. Section 125 of the Code allows employees to pay for health insurance and other group benefits with pre-tax salary deductions. This adds up to significant savings, as you can see in the table below.

Employers meeting the ‘written plan’ requirement to offer tax-favored benefits also gain new tax savings. They do this by eliminating FICA, FUTA, and other payroll taxes on pre-tax plan dollars paid by employees.

Example of Employee Tax Savings with Section 125 Plan

The Series

Our series begins with a brief look at the origins of the medical tax deduction, followed by how that deduction played into lawmakers’ and the Treasury’s intent to make employer-sponsored benefits more available to all workers. Part 3 explores how, during the several years lacking clear guidance from the IRS, employers used the Section 125 rules they knew of in a variety of ways. This includes innovating ideas on the Health Flexible Spending Account, which the IRS was more or less forced to adopt despite the Treasury’s misgivings.

Then, we look at how the Section 125 Cafeteria Plan fared in the face of Obamacare, and close with a quick summary of the plan’s benefits as well as how proposed legislation may affect two of its popular components.

More in the Section 125 Plan’s 40th birthday series: