Home / Blog / FSAs are here to stay: Business and Treasury face off

FSAs are here to stay: Business and Treasury face off

When the Treasury proposed the addition of Section 125 to the Code in 1978, its purpose was making health benefits equally available to all workers. The last thing Treasury wanted was a pre-tax vehicle like the Flexible Spending Account (FSAs).

When the Treasury proposed the addition of Section 125 to the Code in 1978, its purpose was making health benefits equally available to all workers. The last thing Treasury wanted was a pre-tax vehicle like the Flexible Spending Account (FSAs).

There was little chance of it, too, during the first dozen or so years. Businesses were slow to jump onto the Cafeteria Plan bandwagon when Section 125 became law in late 1978. Since the Treasury was slow to issue regulations governing the plans, many tax attorneys advised their clients to stay away from it altogether until official IRS guidance was available.1

401(K) law sparks FSA innovation

That changed abruptly in 1981 when the Treasury proposed allowing pre-tax salary deductions to fund 401(K) retirement accounts. Attorneys reasoned that this meant the Treasury intended to further expand the types of tax-exempt benefit plans available to employers and employees.

Not only did this give tax attorneys confidence to recommend the Cafeteria Plan to employers, but it also led to the birth of the Flexible Spending Account (FSA) for employees. This meant more tax savings for the employee and employer since reducing taxable income not only reduces employee income tax but also eliminates applicable FICA tax for both.

Treasury issues guidance against FSAs

Meanwhile, in 1982’s Washington, the Treasury focused on drafting guidance on the non-discrimination rules of Cafeteria Plans with a secondary goal of proposing rules that would forbid the expansion of benefits paid via employee salary reduction (pre-tax). The reason for the latter was the Treasury’s concern that too much tax revenue would be lost if employers (and their attorneys) found ever more creative ways to use Section 125 tax law for greater tax savings.

It was not until late 1983 that the Treasury learned that FSAs not only existed but were in wide use among employers. In 1984, the IRS issued guidance saying that FSAs or similar ‘reimbursement’ arrangements do not qualify as benefits that reduce an employee’s taxable wages.

The major objection the Treasury had about FSAs was that, at the time, FSAs were designed so that any unused tax-free balance was refunded to the employee at the end of the year.

Employers were not pleased with the anti-FSA guidance on Section 125 Plans. The debate between employers and the IRS led to hearings before Congress. The IRS argued against a benefit not tied directly to health care costs being provided to employees essentially tax-free. Employers insisted that FSAs are essential to keep costs down while making health plans available to all employees, as the Treasury wanted to do.

Use-it-or-lose-it wins

Eventually, the Treasury, business leaders, and Congress agreed that if the entire unused FSA year-end balance were forfeited instead of refunded, the FSA would qualify as a tax-free benefit. This made employees more accountable for how much they would contribute to an FSA, and the accounts less likely to be misused.

However, that would not be the final decision on the disposition of any unused FSA balance. First, employees were given a grace period through March 15 of the following year to use up remaining FSA funds. In 2013, the Treasury gave employers the option of eliminating the grace period and allowing in its place a year-end rollover of up to $500 into the next year’s FSA.

Pending legislation

In 2018, two pieces of legislation passed the U. S. House of Representatives and await consideration by the Senate:

♦ HR 6311 allows a year-end FSA balance to be rolled into an employee’s Health Spending Account (HSA); and,

♦ HR 6199 provides for conversion of an FSA balance into a newly-established HSA.

Today, many financial advisors suggest funding an HSA before making contributions to a 401(K) for retirement. If recently passed HR 6311 and HR 6199 ever see the light of day in the Senate and become law, unused year-end FSA balances would no longer have to be surrendered but could be recovered for that purpose. This would make FSAs a totally safe option for benefit plans which may, to the Treasury’s regret, expand its use for greater tax savings for everyone.

More in the Section 125 Plan’s 40th birthday series:

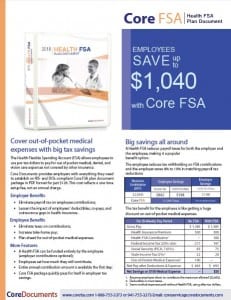

Click to download our Health FSA Plan Document brochure (with forms) — no registration required.

1Fox, D. and Schaffer, D. Tax Policy as Social Policy: Cafeteria Plans, 1978-1985. (1987). In C. Rist (Ed.) Policy Issues for the 1990’s. (1980). Retrieved from https://books.google.com/books