Home / Blog / Tax Cuts and Jobs Act Update 12-15-2017: DCAPs survive

Tax Cuts and Jobs Act Update 12-15-2017: DCAPs survive

Tax Cuts and Jobs Act Update 12-15-2017:

Congress released the conference report with details of what will be in the Tax Cuts and Jobs Act. The bill is expected to be voted on by both chambers and on the President’s desk by the end of next week for signing, which he intends to do as a Christmas gift to the American people.

Here is what the conference report reveals about the pre-tax employee benefit programs we outlined in our November 3, 2017, report.

Click to download.

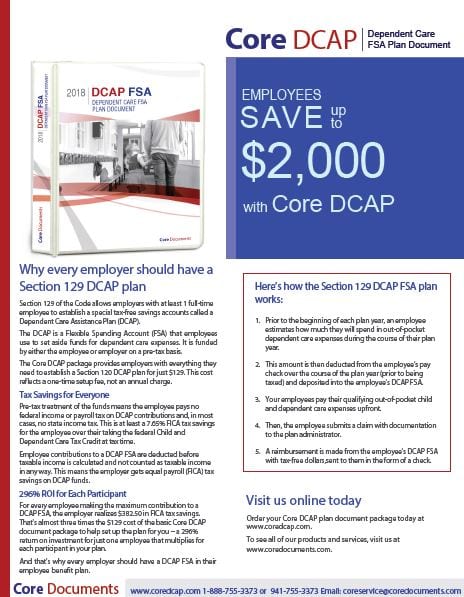

Dependent Care Assistance Programs (DCAPs)

The House version of GOP tax reform contained a sunset for DCAPs from the start, while the Senate version never did.

In conference, the Senate’s version won out on Section 129 plans. That means this valuable employee benefit plan will continue in its present form. (Reference page 632 of the conference report, linked below).

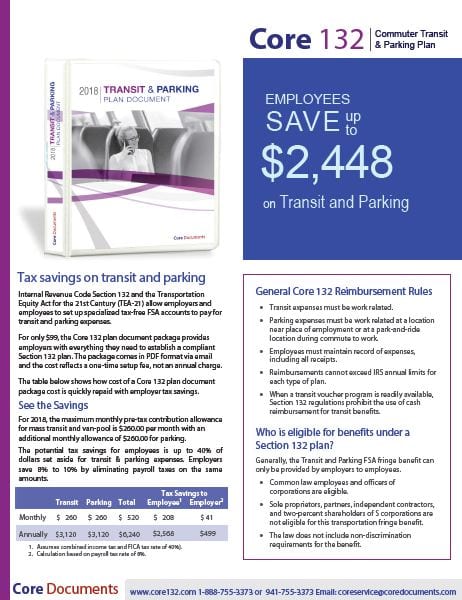

Parking & Transit Plans

Click to download.

Changes are in store for employers sponsoring Section 132 Transit and Parking plans to help cover the cost of commuting for their employees.

Employees can still set-aside pre-tax dollars up to the maximum contribution limits of $260 per month for transit and $260 for parking in 2018. This saves employees up to 40% in income and payroll taxes. Employers also continue to save by eliminating their 7.65% in payroll taxes on employee pre-tax salary deductions.

However, any contributions employers make into employees’ Section 132 plans are no longer tax deductible. (Reference page 774 of the report).

Tuition Assistance

The provision to eliminate the employer tax deduction for tuition assistance plans was in the same section of the House bill as the DCAP provision, which was removed in conference negotiations.

Adoption Assistance

The outcry was so great that this provision did not survive long enough to get to the conference meeting.

========================================

Earlier Reports

========================================

News 12-5-2017: Early versions of The Republican Tax Bill planned to eliminate the Dependent Care Assistance Plan (DCAP) and portions of the Commuter Transit & Parking fringe benefit tax deduction effective January 1, 2018.

Dependent Care Assistance Plan FSA: Current revisions to the Tax Cuts and Jobs Act indicate the DCAP FSA is still be a viable tax-deduction via IRC Section 129 until January 1, 2023. Prior versions of H.R. 1 would have repealed (ended) the Section 129 DCAP deduction effective January 1, 2018.

Transit & Parking Benefit: Current revisions to the tax bill indicate the Transit and Parking FSA is still a viable pre-tax deduction via IRC Section 132 for employees, but not for employers. The Transit and Parking expenses would no longer be a business expense tax deduction to the employer.

The plan is to have the bill reconciled, passed by both houses, and on the POTUS desk before they leave for break on December 15. That’s when we’ll know for sure.

We believe that late night deliberation and revisions made Friday, December 1, 2017 did not change DCAP and Transit & Parking positions compared in these two executive summaries of the House and Senate versions here: Groom Law Group and Kilpatrick Townsend

========================================

Original article posted November 3, 2017

The Republican Tax Reform package heading to Congress in the waning weeks of 2017 has surprises for all of us. One thing most of us probably weren’t expecting is that the Tax Cuts and Jobs Act will try to eliminate tax savings on dependent care, tuition, and adoption assistance plan benefits employers provide for their employees.

That is what the current GOP plan intends to do. It isn’t a sure thing because passage of the tax reform bill is uncertain. If a bill is passed, it will likely see many changes before it becomes law. It depends on what our representatives in the U. S. House and Senate see as the more valuable tax benefits to keep and what can be discarded.

Since these pre-tax benefits are on the GOP’s chopping block for now, we’ll look at what they provide today so our clients can see what is about to be lost. Then, you can decide what action to take, including whether or not to contact your representatives about their plan to DCAP-itate the DCAP as well the others.

Tax Rates, Standard Deduction, and Exemptions

As we look at what is being lost or gained with the passing away of these pre-tax benefit plans, keep in mind it is almost impossible to perfectly compare savings via today’s plans vs. the proposed benefit cuts. This is because of the many other changes within the bill. For example, the proposed tax plan drops tax rates for everyone making less than half a million dollars per year, which is probably most of us reading (and writing) this article. Also, standard deductions will rise under the plan while personal exemptions will be gone.

Where we make calculations, we’ll take our best stab at ‘what may be’ by using the proposed 12% income tax rate for individuals making up to $45,000 and married couples earning up to $90,000.

Tuition Reimbursement

The savvy employer provides a way for employees to accrue knowledge and skills that can be applied to the present job and prepare the employee for advancement within the company.

The savvy employer provides a way for employees to accrue knowledge and skills that can be applied to the present job and prepare the employee for advancement within the company.

Today, that employer can provide up to $5,250 annually to each employee on a tax-free basis. If the tax bill passes, these plans will no longer be available in 2018.

Both the employer and employee benefit from this tax savings in addition to the added value brought to the company and employee through the increased education made more affordable through its tax-advantaged status.

Net loss for employee and employer: Immeasurable.

Adoption Assistance

This is among the least used employer benefits but when it is needed, it is among the most appreciated. Today, an employer can sponsor a reimbursement plan that offers up to the 2017 maximum allowance of $13,570 for eligible expenses an employee incurs in the adoption process. There is also a matching tax credit available for when a couple has expenses exceeding what is available through the employer plan.

This is among the least used employer benefits but when it is needed, it is among the most appreciated. Today, an employer can sponsor a reimbursement plan that offers up to the 2017 maximum allowance of $13,570 for eligible expenses an employee incurs in the adoption process. There is also a matching tax credit available for when a couple has expenses exceeding what is available through the employer plan.

For a family adopting a child from another country, travel expenses and attorney fees in both countries can be daunting. Adoption of a special needs child can mean retrofitting a home to accommodate his or her needs. All of these expenses are currently eligible under an employer plan and the tax credit.

The employer-sponsored tuition reimbursement plan is gone in 2018 if the GOP tax plan goes forward as it is today.

Net loss for employee and employer: Invaluable.

Reforms Not Yet Law

Again, the Tax Cuts and Jobs Act’s passage is not certain to pass and, even if it does, it will probably not retain all the provisions in it today. There will be debate among members of Congress in both houses as to what kind of tax reform is best for their constituents and for the country overall. You can have a voice in that debate by contacting your representatives about what matters to you.

The plan is to have the bill reconciled, passed by both houses, and on the POTUS desk before they leave for break on December 15. That’s when we’ll know for sure.

Core Documents will continue to post updates on the tax bill and other legislation important to our clients. Check back with us regularly to stay informed.

___________________

See: Dependent Care Assistance FSA Plan Documents just $129