Home / Blog / How to find the Plan ID number for your benefit plan

How to find the Plan ID number for your benefit plan

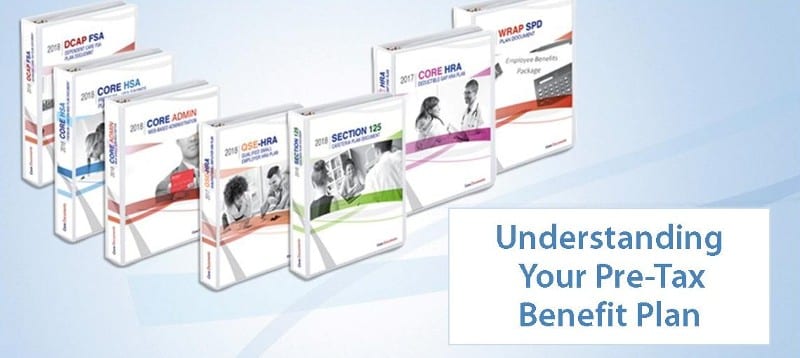

The Plan ID is a 3-digit number used by the DOL, IRS, and ERISA to identify one employee welfare plan from another of a company’s benefit offerings. The Plan ID is used on all of our Plan Document Packages, including the ERISA Wrap Summary Plan Description. Companies with 100+ employees will also need it for their Form 5500 filing.

Every benefit plan has one

Prior to gathering the information needed to order a Core 125 or other plan document package, most employers probably did not know they had or needed a Plan ID. What follows is a brief explanation of what the Plan ID is, where you find one, how to know when to retire one, and how it fits into the full plan number.

Finding the Plan ID

The Plan ID is a 3-digit number that designates one plan from another for the IRS and DOL. Which number goes to what plan is up to the employer in most cases.

In the instructions for Form 5500, the IRS informs us that Plan ID numbers are to begin with 501 for a company’s first health & welfare plan. The second plan is to be numbered 502, a third numbered 503, and so forth. This numbering system continues for as many plans as a company has over its lifetime with only two numbers disallowed: 888 and 999.

Here is an example of how an employer might number the different plans a company provides for employees:

| Employer Benefit Plan |

Plan ID No. |

| Section 125 Cafeteria Plan |

501 |

| Health Reimbursement Arrangement |

502 |

| ERISA Wrap SPD |

503 |

Every company offering a group health plan should have at least two Plan ID numbers active: 501 for the main group health plan (Section 125 or HRA), and 502 for the required ERISA Wrap SPD.

Retiring a Plan ID

A plan retains its Plan ID number for the life of the plan. When changes are made to the plan, the Plan ID does not change. When a plan is retired, however, its Plan ID is, too. That Plan ID number cannot be used for another benefit plan.

For example, a company has offered a Section 125 Cafeteria plan for ten years under Plan ID 501. This year, the employer is changing to a Deductible Gap HRA. The new plan cannot be given Plan ID 501. It will be Plan ID 502. Plan ID 501 will be permanently retired for this employer.

Full Plan Number

When a request is made for the 12-digit plan number, the Plan ID is added as a suffix to the employer’s tax identification number (EIN). A company with EIN 12-345678 and Plan ID 501 for its Section 125 Cafeteria plan enters 12-345678-501 for the full plan number.

Using the same plans as in the earlier table, the full plan numbers would be:

| Employer Benefit Plan |

Full Plan No. |

| Section 125 Cafeteria Plan |

12-345678-501 |

| Health Reimbursement Arrangement |

12-345678-502 |

| ERISA Wrap SPD |

12-345678-503 |

Download a brochure to learn more about our tax-saving plan document packages: