Most small business owners have long wanted to provide some form of health care benefit to their employees. Rising costs, for the most part, made that impossible.

The Health Reimbursement Arrangement (HRA) was an available and versatile tool, but new requirements by the Affordable Care Act (ACA) required that all employers with an HRA to first provide group insurance coverage. Again, impossible for many small employers while premium rates were soaring under Obamacare.

The small business provision of the 21st Century Cures Act rolls back that requirement for qualified small employers (QSEs). A QSE is a company with fewer than 50 full-time employees and offering no group health plan for employees.

This returns the already popular Health Reimbursement Arrangement (HRA) to smaller companies meeting that definition (QSE) with the new QSE-HRA product.

Companies wanting to install a QSE-HRA for their employees simply need to draft a written plan document. The summary plan description (SPD) provided within the plan document package must be distributed to every employee eligible to participate at least 90 days before the start of a plan year.

To celebrate these changes in the law governing HRA’s, Core Documents offers a new Qualified Small Employer HRA package at the low introductory rate of $199.

The Core QSE-HRA plan document package provides employers with everything they need to establish an IRS- and DOL-compliant small employer HRA plan in PDF format for a one-time setup fee, not an annual charge.

These plan documents will make it easy for an entirely new group of small business owners to set up and administer the new Small Business HRA benefit for their employees.

$299 Discounted to $199 one-time fee – in PDF via email*

$349 Discounted to $249 one-time fee – in PDF email* + Deluxe Binder via USPS

Order Online

Our friendly and knowledgeable staff is available to

answer any questions you may have via e-mail or phone call,

Monday through Friday, 9 am to 5 pm ET:

1-888-755-3373

[email protected]

If you are one of these newly-eligible employers, you probably have a lot of questions on exactly how the new Small Employer HRA can help you and your employees. Following is a set of FAQs relating to the Small Employer HRA and what it can do for you.

New Small Employer HRA FAQs

How does the 21st Century Cures Act expand the HRA for small business owners?

Prior to implementation of the Cures Act, employers could not provide an HRA to help employees cover their health care costs unless it was alongside an employer-sponsored group health insurance plan. If the employer could not afford a group health insurance plan, they were prohibited by the ACA to use an HRA to provide health care reimbursement benefits to employees; it was all or nothing. In the face of skyrocketing premiums under Obamacare, many small businesses were prohibited from providing any help to their workers.

Under the Cures Act, employers can fund a QSE HRA to help employees buy their own health insurance through an agent, broker, or on the ACA Marketplace as well as reimbursing qualified medical expenses. There is no longer an ACA requirement to first pay for a group insurance plan.

How does this benefit me and my employees?

Employers previously hamstrung by the ACA group benefit requirement can now use the new Small Employer HRA to help employees purchase health insurance and to reimburse their medical expenses.

Who is eligible to establish a QSE HRA?

Any business owner with fewer than 50 full-time employees can use the new Small Employer HRA to reimburse employees for health care expenses.

Who contributes funds to a QSE HRA?

The HRA can only be funded by employer contributions. Employees cannot add their own funds to the account.

Are there annual contribution limits to the Small Employer HRA?

Yes. An employer can provide up to $4,950 toward individual coverage or $10,000 toward a family plan, per plan year, to help employees purchase health insurance or reimburse medical expenses. These amounts are indexed for inflation and may change annually.

Do these contributions expire at the end of the plan year?

Funds made available to reimburse employee medical expenses may expire at the end of the year or roll over to the next year. That decision is entirely up to the employer.

Which employees can be covered?

Any employee of the company having their own health insurance already purchased either on the independent health insurance market or through an ACA exchange.

Does this impact my employees who buy health insurance on the independent market?

Yes. It gives them additional funds to pay the insurance premium or to reimburse qualifying medical expenses.

What about employees that currently purchase health coverage on the ACA Marketplace?

Employees that have been purchasing their individual or family health insurance plans on the ACA Marketplace may continue to do so, now with additional employer-funded HRA benefits.

Will my employees that currently get a tax credit to help purchase marketplace plans still get it?

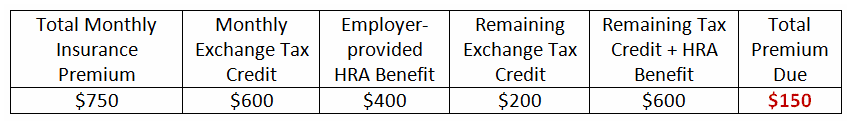

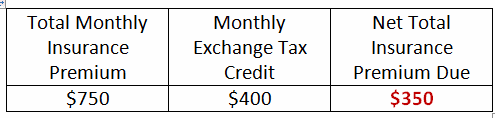

Yes; however, the amount of the credit will be reduced dollar-for-dollar by the amount of the HRA benefit. And yet, in every case, the employee comes out the same or better with the new Small Employer HRA benefit applied.

The following examples show how this works.

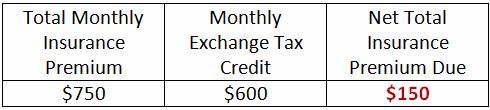

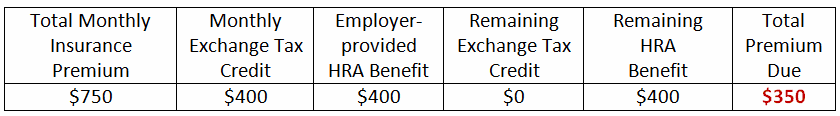

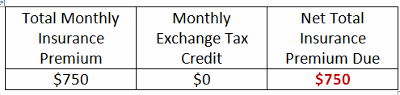

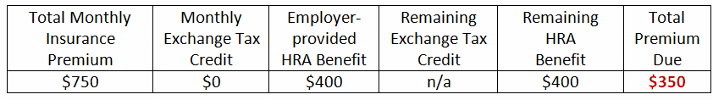

Adam, Betty, and Chris work for ABC Company. They all buy the very same health insurance coverage on the ACA Marketplace with a $750 monthly premium. Each gets a different tax credit to help pay for insurance, but all three have the same $400 per month benefit to use under their company’s new Small Employer HRA plan.

Adam’s Net Premium Cost in both cases is $150:

Betty’s Net Premium Cost in both cases is $350:

Chris’s Net Premium Cost drops $400 with a QSE HRA in place:

How does this change my company’s current HRA?

It doesn’t. If you are happy with the HRA you have now, you can keep it — and this time there’s no bait-and-switch.

Can I keep my stand-alone, one-person HRA?

Yes. No changes were made to the stand-alone, one-person plan.

When does the new Small Employer HRA provision take effect?

January 1, 2017.

How do I set up a Small Employer HRA?

If you are as convinced as millions of other small employers that the updated QSE HRA plan is right for you, place your order today and we will start preparing your plan documents package. Just choose the method of ordering that works best for you:

How much does it cost to set up the new Small Employer HRA plan?

Core Documents’ Small Business HRA package is available at an introductory low price of just $199 (with no renewal fee).

Limited Time Offer at $199

Order Online

Our friendly and knowledgeable staff is available to

answer any questions you may have via e-mail or phone call,

Monday through Friday, 9 am to 5 pm ET:

1-888-755-3373

[email protected]

Core Documents will notify you when there are sufficient changes in the Code to require amending and restating your Plan. You can amend and update anytime for just $199, and only when necessary which is the most cost effective way to establish and maintain a HRA Plan.

*Most documents go out the same day via email within hours M-F. Orders placed on the weekend will be emailed Monday morning. Keep in mind that December, January, and February are our busiest months of the year and documents are processed in the order they are received. The Rush Order fee ($25) simply brings your document to the top of the stack to be processed immediately.

How can I learn more about the new Small Employer HRA and HRA’s in general?

By reading Core Documents’ articles and blog posts on the topic, including:

QSEHRA: The Stand-Alone HRA Returns

How to Report QSE-HRA Employee Benefits on 2017 Form W-2

QSE-HRA Guidance: Eligibility, Terms, Limits and Notice Requirement (Part 1 of 3)

HRAs remain good tax savings option for small business

FSA, HSA, and HRA: What’s the difference?

Meet Core Documents

Core Documents, Inc. has been providing free consulting, affordable plan documents, and plan updates as needed for Section 125 Cafeteria Plans and Health Reimbursement Arrangements since 1997.

Core Documents, Inc. has been providing free consulting, affordable plan documents, and plan updates as needed for Section 125 Cafeteria Plans and Health Reimbursement Arrangements since 1997.

Core Documents retains the services of several ERISA Benefit Attorneys for up to the minute commentary on issues affecting plan document language and administration.

All of our plan documents have been thoroughly reviewed by numerous CPAs and law firms who have found them to be clear, concise, compliant and cost effective.

Our Mission

Core Documents is committed to helping our clients and their employees reduce income tax liability with compliant Plan Documents and Summary Plan Descriptions that allow them to deduct insurance premiums, out-of-pocket medical expenses, dependent care expenses, and commuter and parking expenses before payroll taxes are calculated.

Our Clients

Our clients include small employer groups, PEOs, national payroll companies, certified public accountants, third-party administrators, agents, brokers, a network of hundreds of Flex Affiliate websites, and law firms.

Many PEOs, payroll companies, CPAs, accountants, and attorneys private label Core Documents’ plans to their clients through our Flex Affiliate program.

Our Market

We sell documents and annual document maintenance, as well as state-of-the-art web based administration services, and do-it-yourself Excel administration software. Our target market is the small employer, normally with less than 100 employees. We offer online ordering at our website as well as a fax order form (.pdf download).

Our Founder

The President of Core Documents, Gene C. Ennis, has held:

♦ Certification in Flexible Compensation, (CFC) by the Employers Council on Flexible Compensation,

♦ a 218 Life and Health Insurance license offering Section 125 plans since 1989,

♦ a Third Party Administrator’s (TPA) license administering ERISA self-funded health and welfare plans,

♦ Professional Employer Organization (PEO) license with co-employer responsibility for 500 work site employees, and,

♦ PEO Controlling Person’s license.

Return to Top