Home / Blog / Section 125 Cafeteria Plan Explained

Section 125 Cafeteria Plan Explained

Section 125 Cafeteria Plan Documents

A Section 125 Cafeteria Plan Document can include just one or any combination of three components:

A Section 125 Cafeteria Plan Document can include just one or any combination of three components:

- the $99 Premium Only Plan that allows employees to pay for qualified health, ancillary benefits, group term life, disability, dental, and vision insurance premium with pretax dollars through payroll deduction.

- the $129 Health Flexible Spending Account that allows employees to establish a tax free account with up to $2,500 a year to pay for out-of-pocket medical, dental, and vision expenses.

- the $129 Dependent Care Assistance Flexible Spending Account allows working employees to establish a tax-free account with up to $5,000 for dependent care expenses while the employee works.

Salary deducted funds that an employee sets aside in a Premium Only Plan or a Flexible Spending Account (FSA) are not subject to federal, state, or Social Security taxes. On average, employees save from $.25 to $.49 for EVERY dollar they contribute to the FSA.

Premium Only Plan (POP) Documents

Premium Only Plan (POP) Documents

By setting up a Premium Only Plan (POP), group sponsored insurance premiums can be deducted from each employees paycheck before taxes are deducted.

Internal Revenue Service Code, Section 125, allows employees to purchase health insurance and other accompanying benefits tax-free. The Section 125 Premium Only Plan is an integral part of any small business owner’s employee benefit package.

Flexible Spending Account (FSA) Documents

In a Health FSA, employees can set aside up to $2,500 a year tax-free through regular payroll deductions. In a Dependent Care Assistance FSA employees can set aside up to $5,000 on a pre-tax basis. The employee can then use these pre-tax, or tax-free funds for all eligible medical, dental, vision, and dependent care expenses.

Benefits to the Employer

Benefits to the Employer

Because the full Section 125 Cafeteria Plan reduces taxable income to the employee, employers also realize tax savings from reduced matching FICA, FUTA, SUTA, and Worker’s Compensation taxes on all those tax advantaged employee funds. The tax savings completely eliminates the costs associated with setting up a plan and administering it. Employees are happy because they experience a “raise” without adding any additional cost to the employer.

Increased participation equals greater tax savings to the employer.

Benefits to the Employee

Employees who participate in a Health FSA or Dependent Care FSA choose an amount during open enrollment to set aside in their special medical or dependent care accounts. These elections are automatically payroll deducted from the employee’s paycheck. For example, a participating employee is paid weekly, and chooses to put $1,000 in their Health FSA for medical expenses. The $1,000 annual salary deduction is divided by 52 pay-periods, and $19.23 per paycheck is retained by the employer for that employee’s Health FSA account. The employer then reimburses the employee for qualified medical expenses from their Health FSA as they occur.

Employees who participate in a Health FSA or Dependent Care FSA choose an amount during open enrollment to set aside in their special medical or dependent care accounts. These elections are automatically payroll deducted from the employee’s paycheck. For example, a participating employee is paid weekly, and chooses to put $1,000 in their Health FSA for medical expenses. The $1,000 annual salary deduction is divided by 52 pay-periods, and $19.23 per paycheck is retained by the employer for that employee’s Health FSA account. The employer then reimburses the employee for qualified medical expenses from their Health FSA as they occur.

12 Month Plan Year and 2.5 Month Grace Period

The employer chooses the plan year when ordering the Plan Documents. A plan year is a full 365 day year that normally starts at the beginning of the month. It’s advisable to align your Section 125 Cafeteria plan year with the same plan year as your health insurance plan. However, you don’t have to wait until the beginning of your health insurance renewal to set up a Cafeteria Plan or FSA Plan, you can start a plan anytime by utilizing a short first plan year. Example, your health insurance plan year is January 1 to December 31, but you start your new FSA benefit plans on October 1, so you have a short first plan year ending December 31. Then your next, or second plan year is back on the calendar year, or health plan renewal.

The grace period is a timeframe up to 75 days after the end of the official plan year during which employees may use up any funds remaining at the end of the plan year. For example, if the plan year runs from July 1-June 30, the grace period for that plan may continue up to September 15. If an employee incurs an expense after June 30 but before September 15, they can utilize the remaining funds from the previous plan year and submit requests for reimbursement. In addition to the 75 day grace period, plan participants have an additional 90-day run-out period in which they can submit requests for reimbursement for expenses incurred during the dates of service within the plan year and grace period.

Uniform Coverage

This aspect of Section 125 allows an employee to be reimbursed for qualified medical expenses that exceed their contributions to date. While this is a great benefit for the employee, it poses a potential risk to the employer. A case in point is when an employee terminates with a negative balance in their medical FSA. This risk should be offset because some other employees do not spend all of their FSA funds, so the risk is minimal.

This rule states that for the medical expense account, a participant may claim the full amount of their annual election even if they have contributed only a portion of the total. For example, Sue Summers decides to contribute $480 for the year to her FSA account. To accomplish this, $20 is deducted pre-tax from each of her 24 payrolls for the year. Her plan starts in January. In March, Sue experiences a medical expense that costs $400. To date, she has contributed only $20 on six payrolls, meaning she has only $120 actual dollars in her FSA account. However, due to the uniform coverage rule she can claim and be reimbursed for the full $400 because of the assumption that her bi-weekly contributions will continue and she will eventually contribute the $480 total. This honor system is a huge advantage for participants, and allows them to experience medical expenses at any time of the year with no worry about having the funds available at the time the expense is incurred.

Uniform coverage applies to the medical FSA only; it does not apply to a Dependent Care FSA. With a Dependent Care FSA account, a participant’s reimbursement may not exceed the balance in the FSA account at the time the claim was made.

The Use-It-Or-Lose-It Rule and $500 Carryover Provision

This rule states that any funds remaining in the participating employee’s FSA account at the end of the plan year will be forfeited to the employer. Although the rule is clear, many users of an FSA largely misunderstand the result of the rule: loss of funds can be easily avoided.

Let’s look at an example: Joe Smith chooses to participate in the FSA and elects to fund $500 for the year. After the plan year and grace period are complete, Joe finds that he spent only $400 of the original $500 he put away. He fears he has lost $100, but due to the taxes he saved on the $500 he has not. Let’s say Joe is in the 28% tax bracket. By putting $500 away in his FSA, he saved $140 in taxes (money that was not taken out of his paycheck and given to the IRS). In sum, even if Joe leaves $100 in his FSA account, he has still saved $40! This vital key issue must be explained completely to potential FSA participants.

Plus, with the new Carryover provision implemented on October 31, 2013, employees can carryover up to $500 of unused medical FSA funds from one plan year to the next with no fees or penalties. Carryover enures the participating employee a safety net when determining how much money to set aside in a medical FSA each year. Employees can contribute funds with more confidence, knowing that they will not lose their funds (maximum carryover is $500) at the end of the plan year.

Employees who participate in an FSA should determine the amount to fund by looking at the expenses they will incur in a year; this amount is not an arbitrary number. In this example, let’s say Mary Johnson is married with two school-age children. Mary has glasses and her husband Tom has allergies. When adding up how much to put away in her Medical FSA account Mary looks ahead for the year and determines that one child is going to need dental work, and that Tom has a regular prescription for allergy medicine every month. Mary knows she’ll have a few office-visit co-pays with the kids, too. Adding it all up, she determines she will put away the full $2,500 in her FSA. These are expenses she knows will be incurred. Once again, at an average 28% tax bracket Mary will save $700 by using her FSA! She has no doubt that she should take advantage of her FSA and save this money.

Cafeteria Plans are qualified, non-discriminatory benefit plans, meaning a discrimination test must be met based on the elections of the participants combined with any contribution by the employer.

Nondiscrimination Testing

Section 125 of the Internal Revenue Code requires that Cafeteria Plans be offered on a nondiscriminatory basis. To ensure compliance, the Internal Revenue Code sets forth testing requirements that must be satisfied. These testing requirements are in place to make certain that Cafeteria Plan benefits are available to all eligible employees under the same terms, and that the Plan does not favor highly compensated employees, officers, and owners.

Exceptions

Sole proprietors, partners in a partnerships, and more-than-2% shareholders in an S-Corporation have special considerations concerning participation in a Cafeteria Plan.

While sole proprietors cannot directly participate in the plan, they may legitimately employ their spouse and offer the spouse the benefits of the plan. In such instances, the employer must take care to ensure that the plan must be offered on a non-discriminatory basis. The employed spouse may be considered a highly-compensated employee and as such their contributions to the plan may be limited.

A partnership operates much like a sole proprietorship. While the partners cannot directly participate, they may employ a spouse who in turn may receive benefits. The highly compensated issues apply as stated above.

While all non-related employees may participate in the plan, depending upon the plan’s parameters, non-discriminatory rules apply.

In S-Corporations, eligible employees who are not shareholders and who are not defined as highly compensated generally may participate to the fullest extent. Eligible employees, who are defined as highly compensated, excluding shareholders, will be subject to the non-discriminatory rules.

Special rules apply to a more-than-2% shareholder of the organization. These individuals may not participate in the plan; nor may their employee-spouse, children, parents, and grandparents. In determining the status of an individual that becomes or ceases to be a more-than-2% shareholder during the course of the S Corporation’s taxable year, the individual is treated as a more-than-2% shareholder for the entire year.

_______________________

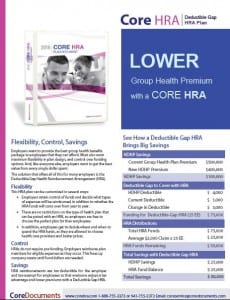

Each brochure below provides a full yet concise explanation of the tax-savings, benefits, and implementation of the respective plan. There is also a form within each brochure that serves as a type of pre-application to help gather information needed in the Plan Document before ordering online.

All of these plans offer employer tax savings of 8% to 10% on average, and employees save as much as 40% in income and payroll taxes on premiums and contributions paid through the plans. The brochures make product comparison more convenient so the right plan is easily determined for the employer.

Executive Summary of Products:

The Core 125 Premium Only Plan allows for tax-free insurance premium (brochure)

The Core HSA allows tax-free Insurance Premium & HSA Savings (brochure)

The Core FSA allows tax-free medical, dental, vision expenses (brochure)

The Core DCAP allows tax-free dependent care expenses (brochure) On hold.

The Core SPD is required by the ACA for all employer group health plans (brochure)

The Core 132 allows for tax-free Transit & Parking expenses (brochure) Anticipating 2018 changes to parking deductions

The Core QSE-HRA allows for tax-free non-group health insurance and medical expenses (brochure)

The Core HRA for 2+ employee groups for tax-free benefits integrated w group health insurance (brochure)

The Core 105 1 employee or spouse (brochure coming soon) (www.core105.com)

The Core Admin – Why Outsource Administration? Convenience. (brochure coming soon) CoreAdmin

Brochures for Tax-Free Benefit Plan Documents: Click on any image below to open and save the PDF Brochure.

Core Documents is committed to helping their clients and their employees substantially reduce their income tax liability with compliant Plan Documents that allow them to deduct insurance premiums, out-of-pocket medical expenses, dependent care expenses, and commuter and parking expenses before payroll taxes are calculated.

Visit Core Documents at www.coredocuments.com and discover how they can save your company more money in the coming year.

In a post-ACA health insurance America, every employer should establish a full Section 125 cafeteria plan or HRA plan to reduce benefit cost and save money.

In a post-ACA health insurance America, every employer should establish a full Section 125 cafeteria plan or HRA plan to reduce benefit cost and save money. Gene C. Ennis

Gene C. Ennis

Download the Core Documents Section 125 Cafeteria Plan Employer Guide HERE