Home / Blog / Section 125 plan for small employers perfect fit

Section 125 plan for small employers perfect fit

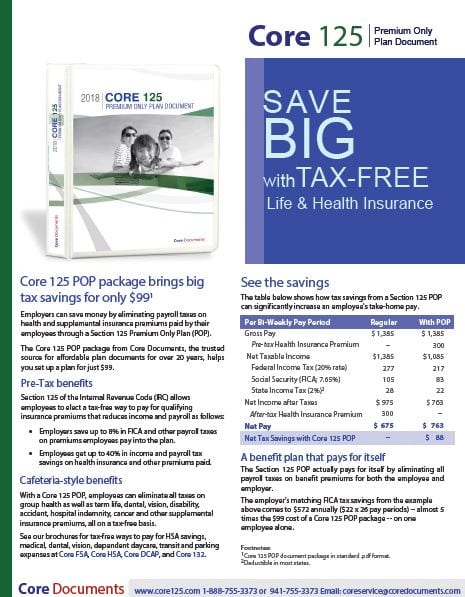

A Section 125 Premium Only Plan or Cafeteria Plan allows employees to use pre-tax salary deductions to pay group health and supplemental benefit premiums in an employer-sponsored plan. This results in tremendous savings for both the employee and the employer.

Employees save because premiums paid are exempt from federal and state income tax as well as Social Security-Medicare (FICA) withholding.

On average, the total employee tax savings is as much as 30% on premiums paid through the plan. The employer also saves the 7.65% FICA tax on those salary deductions.

Section 125 plan for small employers

There are some misconceptions about the Section 125 plan for small employers. Many center around the divide set by the Affordable Care Act (ACA or “Obamacare”) between Qualified Small Employers with fewer than 50 employees and Applicable Large Employers. Since QSE’s are exempt from the employer mandate to provide group health insurance to employees, are these companies also exempt from participation in and certain rules governing Section 125 plans?

Following are the four most common misunderstandings on the Section 125 plan for small employers with our clarifications in response to each:

Qualified small employers are exempt from the Affordable Care Act (ACA, aka “Obamacare”) employer mandate so we are not eligible to sponsor a Section 125 Premium Only Plan.

Employers of any size – even those with as few as one employee – are eligible to sponsor a Section 125 Premium Only Plan.

Since employers with fewer than 50 employees are exempt from the ACA mandate they are also exempt from the requirement for a written Section 125 plan document.

Section 125 of the IRS Code requires an employer have a written plan document in place whether the plan covers 1 or 100,000 employees.

Setting up a Section 125 plan for small employers is a lot of paperwork for just one employee.

Not at all. It’s as easy as sign, copy, and file. Once you receive the Core 125 plan document package via email, open the PDF and print it. Sign the plan document as indicated, give a copy of the Summary Plan Description (SPD) document to every eligible employee, and then file the document with other payroll or personnel papers for future reference. There is no requirement to file or forward the plan document to any agency.

The cost of setting up a Section 125 plan for small employers with only a handful of employees is probably unreasonable.

The cost of a Core 125 plan document package is as low as $99. Plus, that’s a one-time fee, not a subscription requiring annual payments whether or not the plan document needs an update.

That practically guarantees a Section 125 plan for small employers saves a company many times over the cost of the required Section 125 plan document.

According to the Kaiser Family Foundation’s 2017 benefit survey, the average employee pays $5,714 in annual premiums per year for their employer-sponsored health insurance. Using this figure, an employer’s 7.65% FICA savings on one employee will be around $430.

Compared to the $99 cost of a Core 125 plan document package, that’s a better than 400% ROI on one employee alone. This means a Section 125 plan for small employers is an excellent investment that multiplies returns to the smallest employers with every additional employee.

More than Group Health

Alongside employer-sponsored group health insurance premiums, a Section 125 plan can offer employees the chance to pre-tax premiums for supplemental policies such as group life, dental, vision, and certain types of disability and indemnity coverage.

The company can also add the Health Savings Account module and flex spending arrangements like the Health FSA, Limited Purpose FSA, Dependent Care Assistant Plan (DCAP), and Transit/Parking plan.

With every premium or flex contribution an employee makes using pre-tax salary deductions, the employer eliminates more of its FICA tax liability. Savings keep adding up as the plan grows, building an employee benefits plan rivaling larger employers at a reduced net cost (after tax reductions).

Order Core 125 Today!

Bottom line, there is no reason for an employer of any size currently sponsoring group health benefits to not allow employees to pre-tax benefits within a Section 125 POP/Cafeteria plan. Employers of every size are eligible for the plan with the requisite written plan document in place. It is not going to cost the company to procure the plan document because the employer FICA tax reduction on only one employee will more than make up for the $99 cost of a Core 125 plan document package. Finally, installing our plan document package is as simple as sign, copy, and file.

Here’s how to order your Core 125 plan document package from Core Documents, Inc.:

Deluxe Binder Edition |

Save Big with Tax-Free Group

Life & Health Insurance Premiums

$149 one-time fee in Deluxe Binder + PDF email

$99 one-time fee in PDF email only

Order Online

Our secure online ordering system accepts:

If you prefer to order by fax, click here.

|

Please note:

- Most complete document orders placed by 3 PM will be emailed out the same day Monday through Friday. Orders placed on weekends are emailed out Monday morning.

- Keep in mind that December, January, and February are our busiest months of the year and documents are processed in the order they are received. The Rush Order fee ($25) simply brings your document to the top of the stack to be processed immediately.

- Refund Policy: Purchaser understands that goods and services provided by Core Documents, Inc. are non-refundable. Orders cancelled prior to shipping are subject to cancellation fees that are applied to the cost of goods and services provided during the review, draft, and preparation of your order.

Our friendly and knowledgeable staff are available to

answer any questions you may have via e-mail or phone call,

Monday through Friday, 9 am to 5 pm ET:

1-888-755-3373

[email protected]

Watch the Core 125 POP video:

Download the Core 125 Brochure and Forms:

Click to download. |

Download the FREE Core Documents Section 125 Cafeteria Plan Employer Guide:

Click to download. |