Home / Blog / Shared Responsibility Payment – Affordable Care Act (ACA)

Shared Responsibility Payment – Affordable Care Act (ACA)

The Affordable Care Act (ACA), commonly known as Obamacare, has coverage mandates for employers and individuals. In ACA language, the mandates are “shared responsibility provisions.” When an individual or employer does not meet the ACA’s shared responsibility provision, a penalty is assessed. The ACA calls this a “shared responsibility payment.”

When is an employer under the ACA mandate?

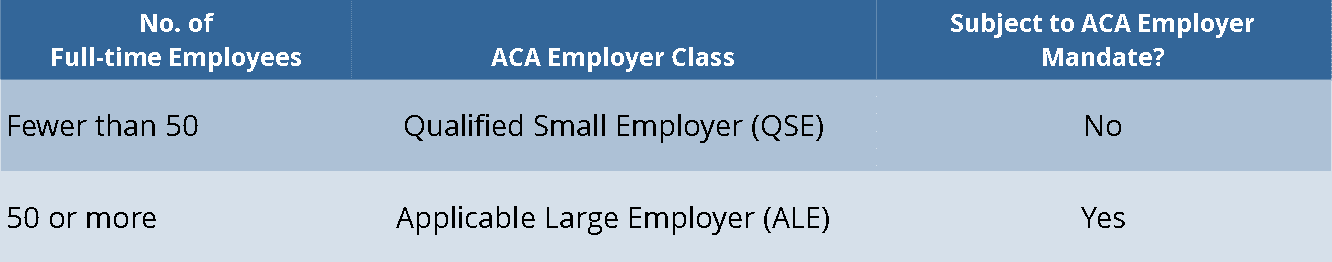

Employers with fewer than 50 full-time employees are exempt from the shared responsibility provision (employer mandate) while those with 50 or more full-time employees are subject to it:

What is a full-time employee?

For the ACA, a full-time employee works 30 or more hours per week (130+ hours per month). There is also a calculation for “full-time equivalent” employees. That is, “(a) combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee.”

ALE shared responsibility provision options

The shared responsibility provision for ALEs states that these employers will provide minimum essential coverage (MEC) that is “affordable” and that provides “minimum value” to 95% of their full-time employees (and their dependents).

An ALE may choose to provide this coverage or to pay the shared responsibility payment instead.

ALE shared responsibility payment

The shared responsibility payment for employers choosing to forego the shared responsibility provision requirements is a per-employee fine of $2,330 annually ($193.33 per month in 2018). The number of employees for purposes of this payment is all full-time employees minus the first 30 employees.

ALE with subminimal coverage

What happens when an ALE provides a health plan for employees but it does not meet the ACA definition of MEC, “minimum value” or “affordable”?

In this case, the employer is subject to the standard shared responsibility payment with the added bonus of paying $3,480 annually ($290 monthly in 2018) for each employee that receives a premium tax credit to purchase coverage on the health insurance marketplace. That amount is in place of the usual $2,330 ($193.33 monthly), not in addition to it.

Premium tax credit reporting

To determine who owes a shared responsibility payment, the IRS compares the health plan information on an employee’s Form W-2 with information from the health insurance marketplace and employee’s tax return. When an employee of an ALE-class employer receives a premium tax credit, the IRS may charge the employer a shared responsibility payment (according to rules outlined above).

If the employer (ALE) did not provide coverage that is affordable and provides minimum value as defined by the ACA, the penalty might be legitimate. The employer will have to pay it.

An ALE that meets the shared responsibility provision will sometimes receive notice of an employee receiving a premium tax credit. It may be that the employee received a health insurance marketplace premium tax credit that he or she was not eligible to receive. The employer will not owe the shared responsibility payment.

Individual shared responsibility payments

When an individual without employer-sponsored coverage does not carry the required MEC, there may be an individual shared responsibility payment due at tax time. This fine is usually incurred by self-employed individuals or employees of QSEs (small employers not under the employer mandate). The liability for this shared responsibility payment falls entirely upon the individual and is not related to the employer in any way.

Need to know more?

The information here is general in nature and only intended to give the reader a broad overview of the topic. Core Documents does not give legal or tax advice because we are not lawyers or accountants. For legal or tax advice for your specific situation, you should contact a competent, licensed professional.