Home / Blog / Will the Section 132(f) Bicycle Commuter Benefit survive tax reform?

Will the Section 132(f) Bicycle Commuter Benefit survive tax reform?

Few of us take a bike ride to work, so why is the GOP tax bill so determined to take away the small benefit allowed them for the purchase and upkeep of a bicycle? That’s what numerous communities and cyclist groups want to know when they write or call their representatives in Congress. Meanwhile, employers looking to update the plan documents for their tax-free employee transit plans are wondering, “Will the Section132(f) Bicycle Commuter Benefit survive tax reform?”

In 2009, the Bicycle Subsidy Benefit Program was added to Section 132(f) of the Internal Revenue Code (the Code). That’s the section of “certain fringe benefits” that designates the “Qualified Transportation Fringe” benefits that an employee may receive tax-free and which an employer may deduct as an operating expense.

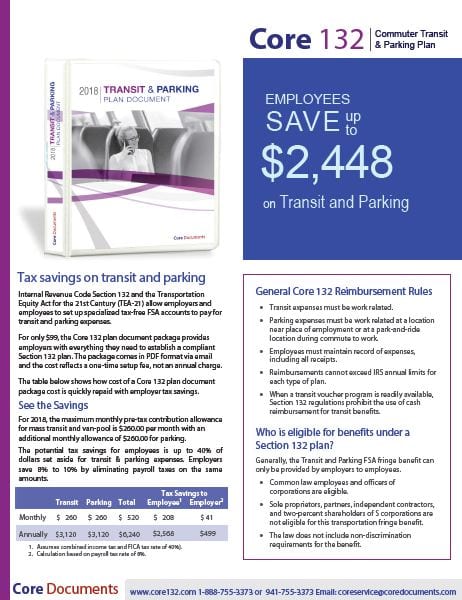

To set up a Section 132(f) Transit & Parking pre-tax benefit plan for employees, which includes the bicycle program, an employer only needs to put the correct Plan Document in place. The employee receives funds from the employer on a tax-free basis, saving both income and payroll taxes, while the employer saves by deducting the amount paid to the employee from the company’s taxable revenue. It is a popular pre-tax benefit, especially in urban areas.

UPDATE 12/15/2017: The Tax Cuts and Jobs Act that Congress will vote on the week of December 18, 2017, eliminates favorable tax treatment of the Bicycle Commuter Benefit for employees. This means that employers will no longer be allowed to take their payment of the benefit as a tax deduction. That does not necessarily mean that all employers will drop the benefit, for other perks of the program may make it worthwhile to continue. If you are currently receiving this benefit, check with your employer. To read our general update on GOP tax reform’s effects on pre-tax ‘fringe benefit’ plans, see our post here.

Transit Benefits and Tax Reform

All commuter fringe benefits are under some level of threat in the Tax Cuts and Jobs Act but the bicycle program faces total elimination. The Senate must expect to save the government a lot of money by suspending it effective January 1, 2018 through December 31, 2025. Let’s look at what the program costs.

The Section 132(f) bicycle reimbursement portion allows that companies may reimburse employees on a pre-tax basis up to $20 per month to cover the reasonable expenses of purchasing and maintaining a bicycle that is used to get to work. The government does not pay out $20 per month to persons riding a bike to work. It only fails to collect income and payroll taxes on it. That comes to between $60 and $96 per cyclist, per year on the full $240 annual benefit.

How Many Cyclists take the benefit?

The League of American Bicyclists estimates 864,000 individuals use a bicycle as their primary transportation to work. That’s less than 1% of the American workforce. Out of this group, only 7% work for companies that have a Section 132(f) plan in place to provide the up to $240 annual reimbursement. The total net benefit to the government is about $4 million.

Many communities encourage biking to work. It relieves traffic congestion and reduces highway pollution. This commuter benefit was established as part of the Clean Air Act (1993) to do exactly that. If you value the Section 132(f) bicycle and other commuter benefits for your employees or for yourself, get in touch with your Senator or U. S. Representative to let them know. And check back here for updates on the progress of tax reform and your commuter benefits.

⇒ Click the image below to download our Core 132 plan document package brochure:

Click image to download Core 132 brochure and plan design forms.