Core Documents, the country’s premier provider for affordable tax-free benefit plan documents, has just released new 2026 product brochures for tax-free benefit plan documents, including Section 125 POP, Health FSA, Wrap SPD, and HRA Plan Documents.

The brochures make product comparison more convenient so the right plan is easily determined for the employer. Simply download the .pdf and print a brochure.

We encourage our clients, employers, agents, and affiliates to view and download the entire line of our brochures for tax-free benefit Plan Document packages:

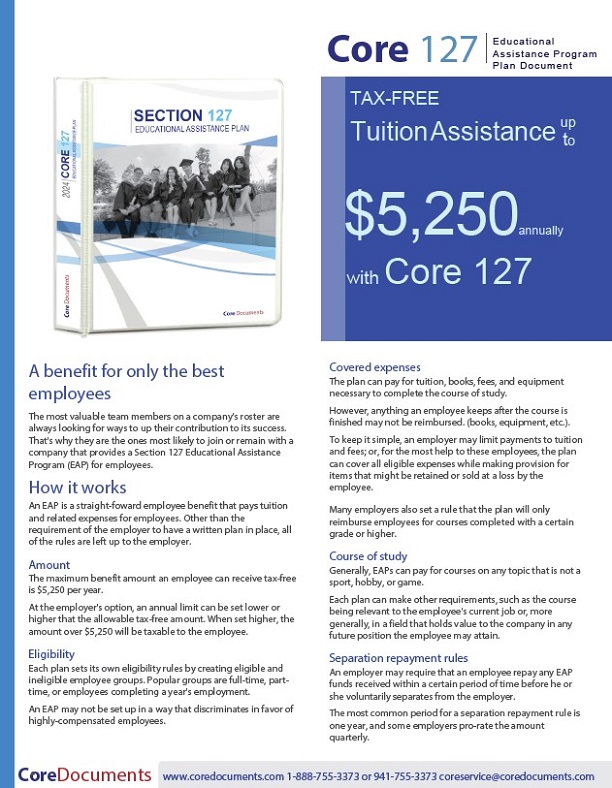

Each brochure provides …

a full yet concise explanation of the tax-savings, benefits, and implementation of the respective plan.

There is also a form within each brochure that serves as a type of pre-application to help gather information needed in the Plan Document before ordering online.

Executive Summary of Plans …

The Core 125 Premium Only Plan allows for tax-free insurance premium (brochure) (webpage)

The Core HSA allows tax-free Insurance Premium & HSA Savings (brochure) (webpage)

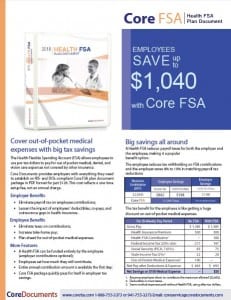

The Core FSA allows tax-free medical, dental, vision expenses (brochure) (webpage)

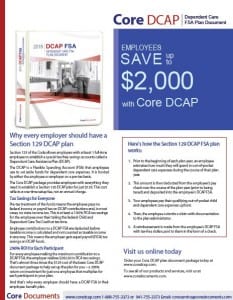

The Core DCAP allows tax-free dependent care expenses (brochure) (webpage)

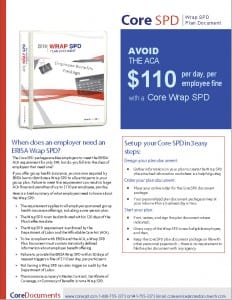

The Core SPD is required by the ACA for all employer group health plans (brochure) (webpage)

The Core 132 allows for tax-free Transit & Parking expenses (brochure) (webpage)

The Core QSE-HRA allows for non-group health insurance and medical expenses (brochure) (webpage)

Core IC HRA allows for non-group health insurance and medical expenses (brochure) (webpage)

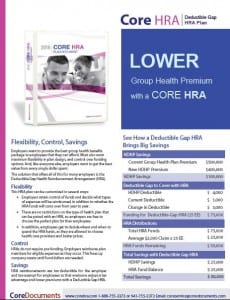

The Core HRA for 2+ employee groups for tax-free benefits integrated with group health insurance (brochure) (webpage)

The Core 105 1 employee or spouse for tax-free medical and insurance premium (brochure) (webpage)

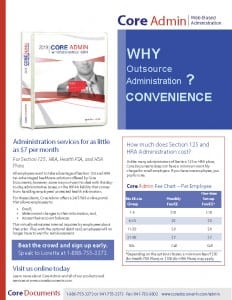

The Core Admin – Why Outsource Administration? Convenience. (brochure) CoreAdmin

Employer Tax Savings …

All of these plans offer employer tax savings of 8% to 10% on average.

Employee Tax Savings …

Employees save as much as 40% in income and payroll taxes on premiums and contributions paid through the plans.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.