Employees receiving claim payments (fixed-indemnity sick pay) from policies with premiums paid with pre-tax salary deductions, as well as the employers providing the policy through a Section 125 Cafeteria plan, may face major tax consequences.

The Internal Revenue Service (IRS) released a Memorandum from its Office of Chief Counsel on the topic of taxation of payments received through fixed-indemnity sick pay health insurance plans when the premium is paid through one’s place of employment

When Proceeds Become Taxable Income

IRS Memorandum 20170313 (dated 12/16/2016; release date 1/20/2017), addresses tax implications for fixed-indemnity policies such as Hospital Indemnity, Intensive Care Policies, and those providing Cancer and other specific Dread Disease coverage. The memorandum answers whether or not payments received by an employee under these types of fixed-indemnity sick pay health plans, when the premium payment for the plan comes from an employer, are to be included in the employee’s gross income.

The short answer is, “Yes,” when the premium for these policies is paid with pre-tax salary deductions from an employer’s Section 125 plan.

What this means for Section 125 plans

The answer rests on three words: “from an employer.”

Here is the key text from IRS Publication 15-A, Employer’s Supplemental Tax Guide, at the top right column of page 16:

Contributions to a sick pay plan through a cafeteria plan (by direct employer contributions or salary reduction) are employer contributions unless they are after-tax employee contributions (that is, included in taxable wages).

Basic Points defining “from an employer”

All of this might come as a surprise to many employers and employees, so here are the basic points:

- When an employee receives payment from a fixed-indemnity sick pay health plan,

- Provided through premiums paid directly by the employer, or,

- Through pre-tax payroll deductions in a Section 125 Cafeteria Plan,

- The employee is subject to withholding for income and payroll taxes on the payment, and,

- The employer is liable for payroll taxes on it.

Fixed-Indemnity Sick Pay: Administrative Responsibilities

When these fixed-indemnity health plan premiums are paid “from the employer,” the payments made by the insurer on a claim become sick pay subject to the same taxes as wages. The insurer acts as a third party, not an agent of the employer. Per Publication 15-A:

If the third party is paid an insurance premium and isn’t reimbursed on a cost-plus-fee basis, the third party isn’t your agent.

Withholding taxes from the third-party payment to the employee is the responsibility of the third party, in this case, the insurer:

A third party that makes payments of sick pay other than as an agent of the employer is liable for federal income tax withholding (if requested by the employee) and the employee part of the social security and Medicare taxes.

The third party (insurer) is also responsible for the employer part of FICA and FUTA taxes unless the third party transfers that responsibility to the employer in a timely manner. The transfer must be done according to the following IRS standards requiring that the third party (insurer):

- Withholds the employee part of social security and Medicare taxes from the sick pay payments.

- Makes timely deposits of the employee part of social security and Medicare taxes.

- Notifies the employer for whom the employee normally works of the payments on which employee taxes were withheld and deposited.

- The third party must notify the employer within the time required for the third party’s deposit of the employee part of the social security and Medicare taxes.

To determine taxable vs. non-taxable amounts, the third party is not to rely upon information provided by the employee but should request information from the employer, including:

- The total wages paid to the employee during the calendar year.

- The last month in which the employee worked for the employer.

- The employee contributions to the sick pay plan made with after-tax dollars.

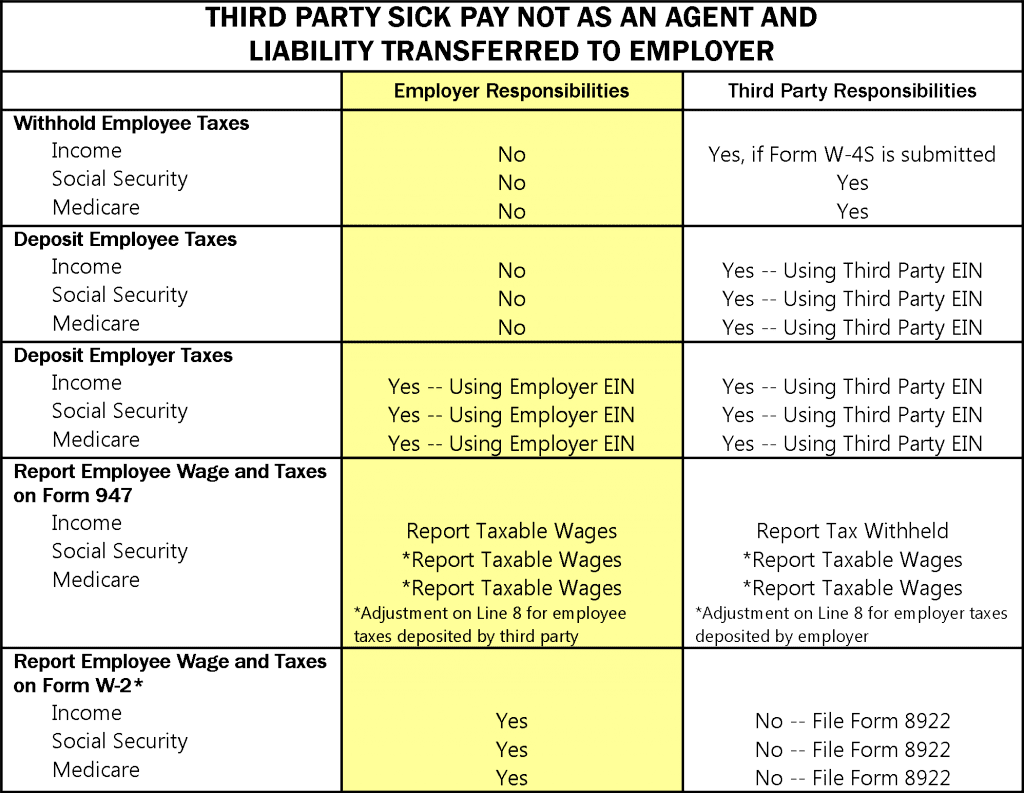

The following table is found on page 21 of IRS Publication 15-A:

1099 Reporting and Payroll Tax Liability

Employees receiving a claim payment from one of these plans (having paid premiums via pre-tax salary deductions in an employer’s Section 125 plan) may not know it is taxable income until tax time, when the insurer issues a 1099 for the amount paid the employee. Receiving the 1099 will spur the employee to seek tax advice on the matter and it will be handled appropriately when it comes to income tax.

What may be new to employees, employers, and maybe to some insurers, is that these payments “from an employer” are also subject to payroll taxes on behalf of both the employee and the employer. This is what IRS Memorandum 20170313 clarifies.

- Employers should carefully consider the additional tax liability that may be incurred before offering this specific type of insurance premium vs employee pre-tax salary deductions in a Section 125 plan.

Note that this is not a new law or a new tax. The rule has been stated in IRS Publication 15-A at least since 2006, along with which party must withhold and report.

Core Documents provides this information as a service to our clients offering fixed-indemnity sick pay policies to their employees through a Section 125 Premium Only (Cafeteria) Plan. Please note that Core Documents, Inc., and its affiliates do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors on how this information may or may not apply to your situation.