Home / Blog / Can employers add to employee Health FSA contribution?

Can employers add to employee Health FSA contribution?

Employer Health FSA contributions drive goodwill, better health security for employees, and bigger tax savings for both. Learn more about employer options in matching contribution methods.

Employee contributions

A Health FSA is a part of an employer’s Section 125 plan that allows employees to set aside pre-tax dollars to pay for out-of-pocket medical expenses. During the employer’s open enrollment period each year, every employee determines how much to set aside for the health FSA contribution by estimating eligible out-of-pocket medical expenses throughout the plan year. That amount is then divided into every pay period as a pre-tax salary reduction.

Employer sets Health FSA rules

Employees decide how much they need in a Health FSA, but when it comes to how FSA contributions are managed, the employer sets all the rules, including:

- While there is an annual limit for employee Health FSA contributions ($2,850 in 2022) an employer may limit its employees to less than $2,850.

- The employer also decides the provision for any unused Health FSA balance at the end of the year (grace period, partial roll-over, or surrender).

And, it is up to the employer whether or not to contribute to their employees’ Health FSA.

*The annual limit is usually adjusted upward for inflation each year.

Employer Contribution Amounts

The IRS puts a limit on an employer’s contribution to the Health FSA based on how much the employee contributes:

- An employer may match up to $500 whether or not the employee contributes to a Health FSA.

- Starting at $501, however, employers may only make a dollar-for-dollar match to the employee’s contribution.

Employer Contribution Methods

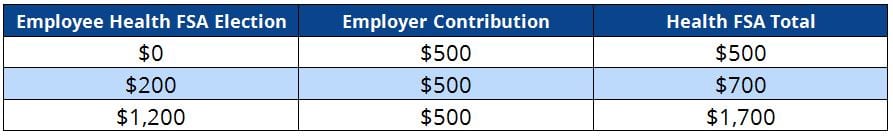

Defined Contribution

Many employers contribute a set amount to all employees’ Health FSAs, even if the employee does not contribute at all.

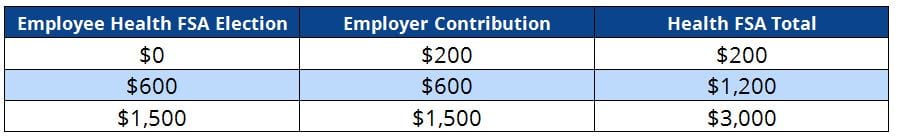

The following table shows three common scenarios under the defined contribution method.

Dollar Match

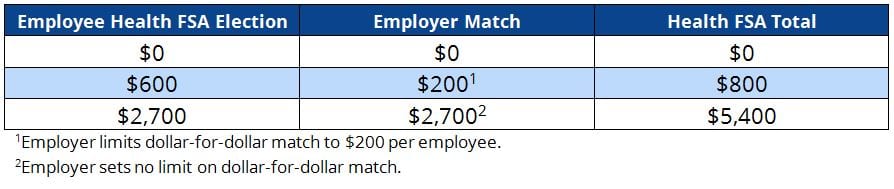

The employer’s Health FSA contribution can be a dollar-for-dollar match to employee contributions.

- The employer may match 100% of an employee’s election;

- Or, the employer may choose to match up to a certain amount.

The table below shows three scenarios under these plan rules.

Crossover

An employer may use a set minimum Health FSA contribution and dollar match together. For example:

- Employer provides a $200 contribution for all employees, even those with $0 Health FSA elections.

- Additionally, the employer makes a dollar-for-dollar match of employee election amounts of $201 or higher, up to the full election amount.

Video: How to reduce taxes with a Health FSA for employees

Brochures (with forms) for Health FSA and related plan document packages

Click image to download: