Home / Blog / HSA Contribution Limit Rises for 2019 -- IRS RP 2018-30

HSA Contribution Limit Rises for 2019 — IRS RP 2018-30

The Health Savings Account (HSA) is growing in popularity. No wonder, since it does double duty, setting aside pre-tax salary deductions that cover today’s eligible out-of-pocket healthcare expenses with unused funds at the end of the year going into retirement savings. That makes it doubly-good good news when the Internal Revenue Service (IRS) announces an increase in the 2019 HSA contribution limit.

The HSA Contribution Limit increase for 2019 is great news for those of us wanting to save for both healthcare expenses and retirement.

Annual adjustment and non-calendar based plan years

Every year, the IRS issues revised benefit limits for defined benefit plans that by law are indexed to inflation annually. The amounts usually stay the same or increase, as is the case for 2019.

The annual contribution limit applies to pre-tax dollars deposited into a person’s HSA during a calendar year. When the plan provider (usually the employer) has a plan year that does not align with the calendar year, the HSA contribution limit for the plan year must be pro-rated accordingly.

For example, a company’s plan year runs from June 1, 2017, through May 31, 2018. The 2018 family coverage contribution limit for HSAs is $6,900, or $575 per month. In 2017, the annual limit was $6,750, or $562.50 per month. The limit for the plan year is calculated for seven months at the 2017 rate ($3,937.50) and five months at the 2018 level ($2,875) for a maximum HSA contribution limit (with family coverage) of $6,812.50 in this particular 2017-2018 plan year.

HSA contribution limit increase

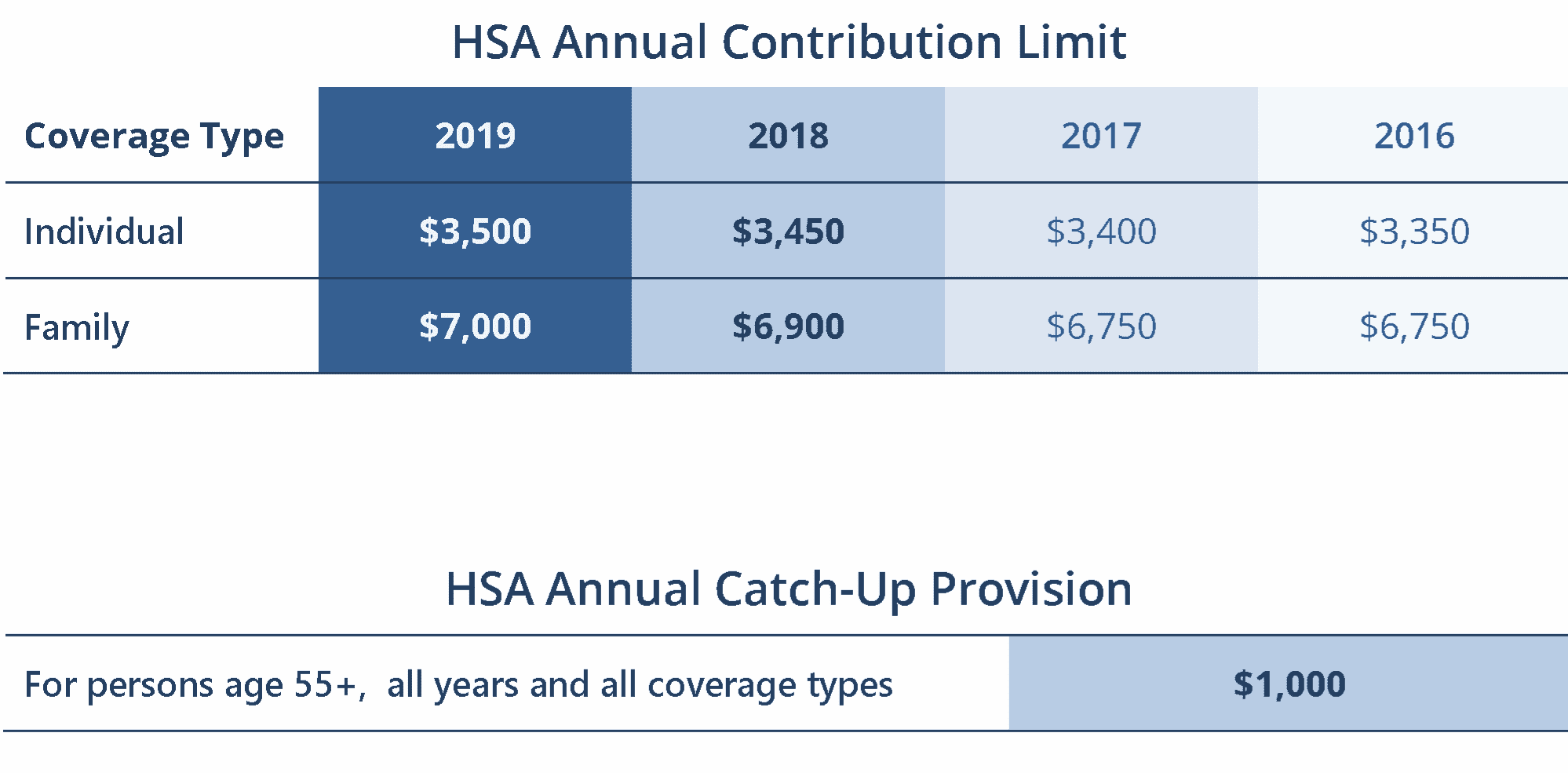

For 2019, the HSA contribution limit for people with individual HDHP coverage rises from $3,450 to $3,500. The limit for those with family coverage goes from $6,900 to $7,000. The additional annual catch-up allowance for persons 55 years and older remains at $1,000. (Ref. IRS RP 2018-30.)

HDHP limits

Other inflation adjusted amounts for HSAs in 2019 relate to the high-deductible health plans (HDHP) that the HSA owner (employee) is required to have alongside the HSA. These figures cover the minimum deductible amount and the maximum out-of-pocket amount.

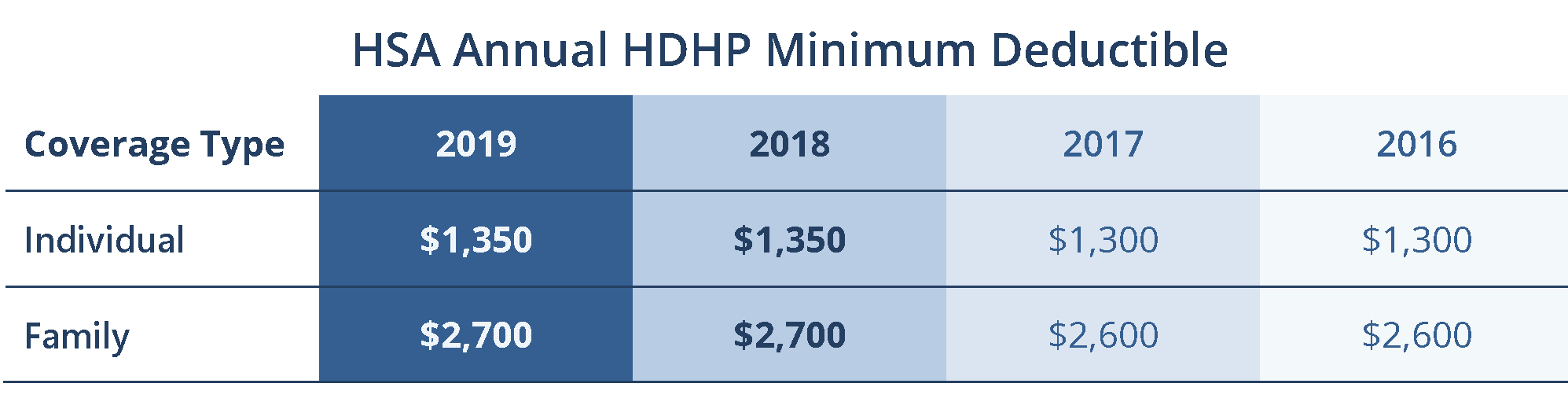

The minimum deductible of an HDHP is unchanged for 2019. Self-only coverage remains at $1,350, and family coverage at $2,700.

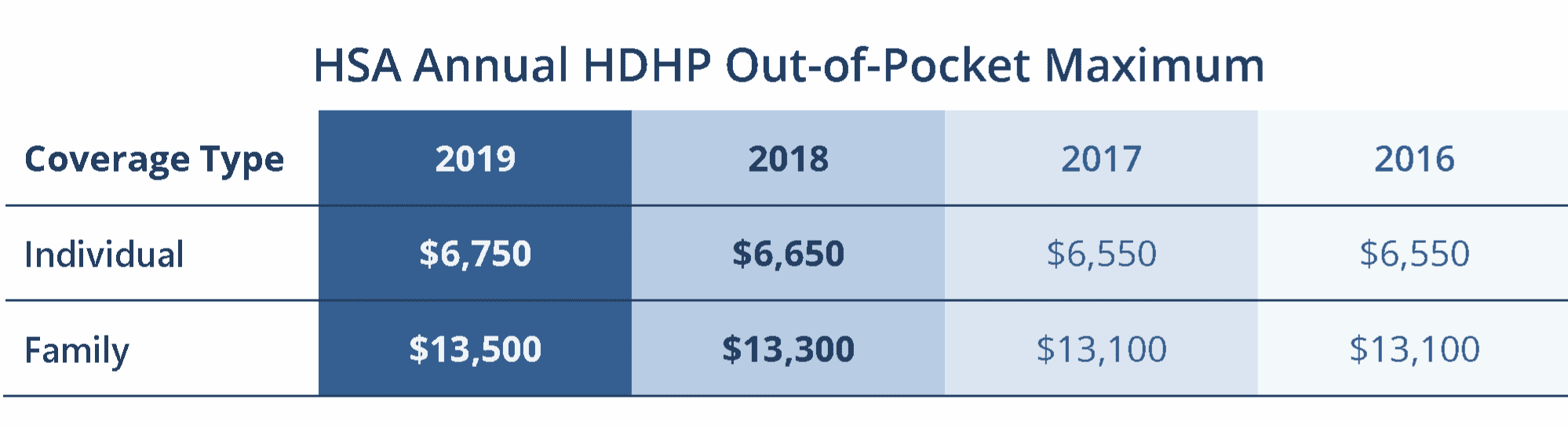

The out-of-pocket limit includes all amounts paid by the HSA owner (employee) during a plan year. These costs encompass the deductible, co-pays, and co-insurance. In 2019, the out-of-pocket maximum allowed under an HDHP for HSA owners rises to $6,750 for those with individual coverage and $13,500 under family coverage.

Maximize Tax Savings

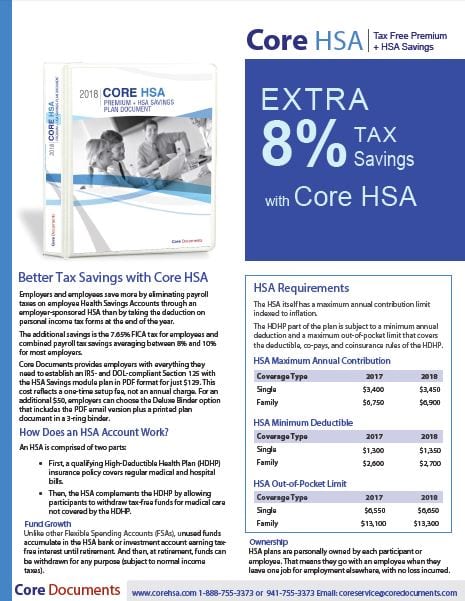

HSAs in an employer-sponsored benefit plan enjoy an additional 7.65% tax savings over HSAs owned outside of an employer plan. That means an additional $535.50 for people taking advantage of the 2019 maximum family HSA contribution limit.

This additional savings comes from Social Security (FICA) tax that can only be eliminated on HSA contributions when made through pre-tax salary deductions. The employer shares the same FICA tax savings by reducing overall payroll upon which employer taxes are determined.

Video:

Free download:

Click image to download