Home / HSA limits -- Health Savings Account HDHP min/max contributions

HSA Limits: Maximum contribution, maximum HDHP out-of-pocket, minimum HDHP deductible

The Internal Revenue Service announces inflation-adjusted figures for Health Savings Account limits in 2020. Amounts increase for self-only and family coverage contributions as well as the minimum annual deductible and maximum out-of-pocket for the high-deductible health plan that is required for HSA eligibility.

HSA Limits for 2020

Rev. Proc. 2019-25 from the IRS announces inflation-adjusted amounts for Health Savings Accounts in the 2020 calendar year, in accordance with § 223 of the Code.

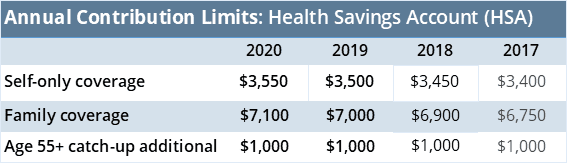

Contribution limits

Persons with self-only HDHP coverage may deposit up to $3,550 in calendar year 2020; those with family coverage may deposit up to $7,100.

The contribution limit applies aggregately to deposits by the account owner, employer, and any others.

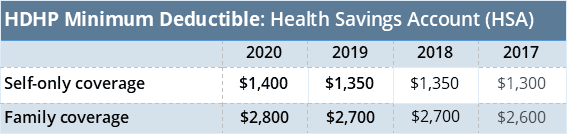

HDHP minimum deductible

The deductible of the HDHP that makes an individual eligible for HSA contributions in 2020 must be at least $1,400 for self-only plans and at least $2,800 for family coverage.

HDHP Out-of-pocket maximum

The total of the HDHP deductible, co-payments, and other amounts (but not premiums) paid directly (out-of-pocket) by the HSA account owner may not exceed $6,900 for self-only coverage or $13,800 for a family plan.

Catch-up provision

The catch-up allowance for persons age 55 and older is not adjusted annually. It remains at $1,000 for calendar year 2020.

Plan document updates

Generally, a company’s Section 125 Cafeteria HSA plan document does not need updated for these annual changes because the plan document is written to reflect whatever the IRS limit is for the year, or for a set dollar amount lower than the IRS limit.

Employers wanting to update a plan document to change a stated dollar amount, or to restate the Section 125 plan for any other reason, can do so quickly and conveniently with our secure online order form.

Summary

The following tables summarize HSA amounts for calendar year 2020:

The Trusted Source of Affordable Benefit Plan Documents for over 20 Years.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.