Home / Blog / Cafeteria Plan Options for 2025 -- Section 125 POP, HSA, FSA, DCAP

Cafeteria Plan Options for 2025 — Section 125 POP, HSA, FSA, DCAP

Since 1978, the Section 125 Cafeteria Plan has helped employers and employees eliminate income and payroll taxes on health insurance premiums and out-of-pocket medical expenses. All the IRS Code requires is that the appropriate written plan document be in place before tax savings can be taken. For employers wanting to set up a plan, or whose plan document is more than 5 years old, here is a quick review of Section 125 Cafeteria Plan Options for 2025.

Executive Summary for Accountants and Employers

Section 125 Cafeteria Plan Options for 2025

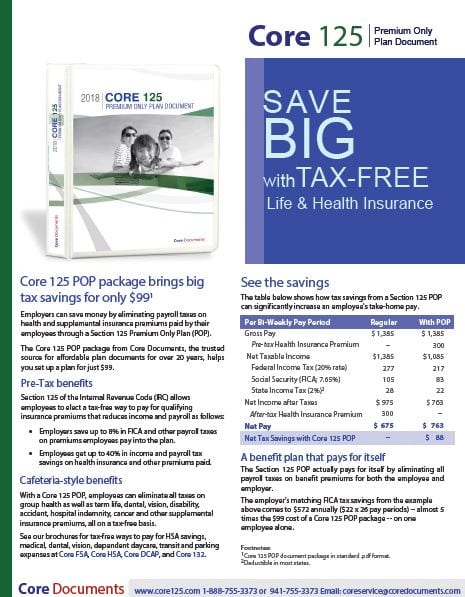

Section 125 Premium-Only Plan (POP)

It all starts with a basic POP that allows employees to elect to pay group health insurance and supplemental insurance premiums with pre-tax dollars. This arrangement results in savings of up to 40% for employees (income and payroll tax combined). The employer also saves on average 8% to 10% by eliminating payroll and other taxes (workers’ compensation, for example) on the amount of premiums paid by employees. Click here for more information.

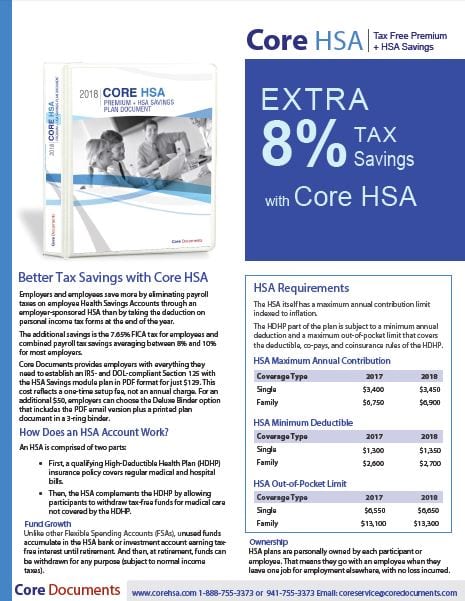

Health Savings Account (HSA)

HSA assets are projected to have grown by 20% over the previous year. The reason for their popularity is the multi-benefit approach the accounts offer. First, an HSA is a flex account vehicle to help with today’s out-of-pocket medical expenses like deductibles, co-pays, and prescriptions. An HSA is designed to roll over unused funds in an interest-bearing fund account that is owned by the employee. At retirement, funds can be withdrawn for any reason, subject to regular income tax. More . . .

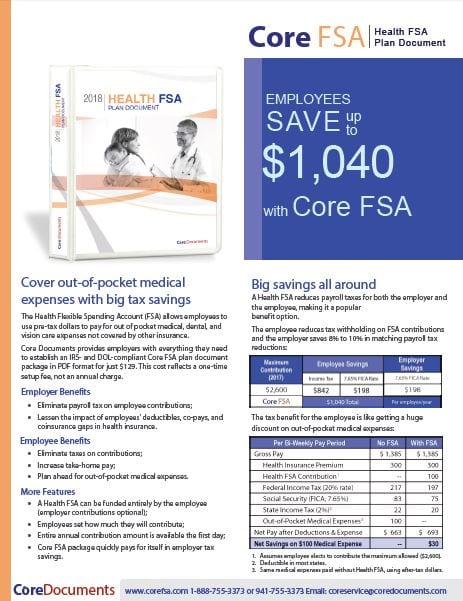

Health Flexible Spending Arrangement (FSA)

The Health FSA is the traditional flex account that allows contributions of up to $3,300 per employee (2025), on a pre-tax basis. For the employee, that’s like getting a 30% discount or health care products and services such as deductibles, co-pays, prescriptions, and many over-the-counter medical products without a prescription. Employers save payroll taxes on employee contributions, too. More . . .

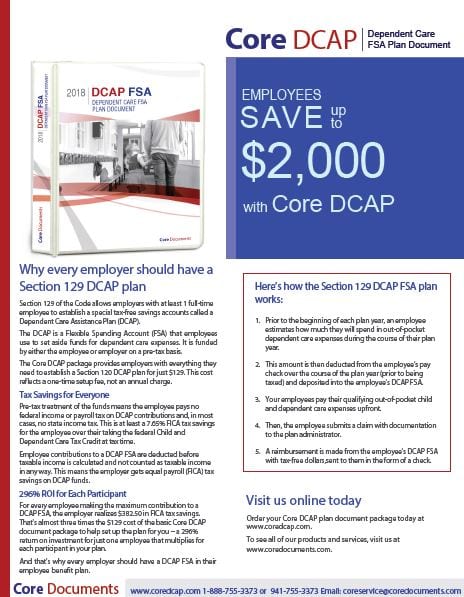

Dependent Care Assistance Program (DCAP FSA)

Employers with even one employee paying for daycare expenses should sponsor a DCAP. Employer payroll tax savings alone on one employee making the maximum contribution of $5,000 per year amount to $382.50. That’s an ROI of just under 300% over the one-time plan document price of $149. More . . .

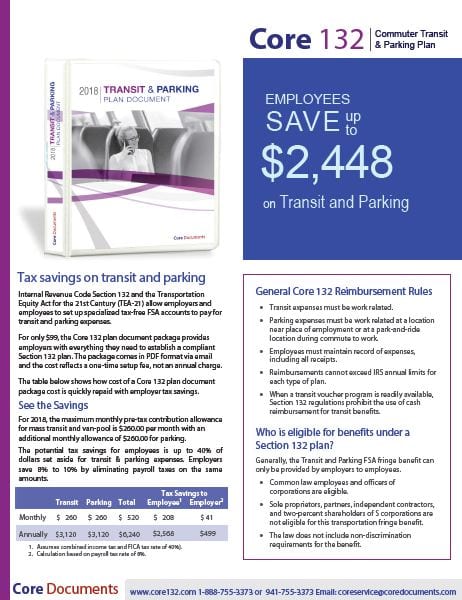

Parking & Transit Plan

With a Section 132 Transportation plan benefit, employees deposit up to $325 per month for parking expenses and $325 per month for transit expenses, on a pre-tax basis. Employees save income and payroll taxes with the pre-tax salary deduction and employers eliminate payroll tax on employee contributions. For employees who ride a bicycle to work, an employer may offer a bicycle benefit of up to $20 per month. More . . .

Important: GOP tax reform impact on Section 132 commuter benefits: Amounts given by the employer to the employee to cover transportation costs are no longer deductible for the employer. However, employers can still reduce annual payroll taxes by as much as $468 or more per participating employee. More . . .

Core 125 POP video

More Cafeteria Plan Videos:

Download our brochures to learn more about Section 125 plan options:

Click to download Core 125 brochure and forms.

|

Click to download Core HSA brochure and forms.

|

Click to download Core FSA brochure and forms.

|

|

Click to download Core DCAP brochure and forms. |

Click to download Core 132 brochure and forms. |

Click to download Core 125 Cafeteria Plan Employer Guide |

|

For more information to help you decide which Section 125 POP plan design option is best for you, send us an inquiry or call our friendly, knowledgeable staff at 1-888-755-3373.

No annual fee — Core Documents does not require an annual renewal fee to maintain your plan document package. A plan document only needs to be updated when there are changes in the plan or in the law that make it necessary. We will notify you when there are sufficient changes in the Code to require amending and restating your Plan and ask that you keep us informed when there is a change to your plan. You can amend and update your plan document anytime, at a discounted fee and only when necessary, which is the most cost-effective way to maintain it.

Fast Service — Most orders placed by 3 PM are returned via email the same day, Monday through Friday. Weekend orders are sent out Monday morning. Plan document packages are processed in the order received. During our busiest months (December, January, and February), the rush order fee (see order form) marks your document to be processed immediately.

The Trusted Source of Affordable Benefit Plan Documents for over 20 Years.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.