Home / Blog / Small employer benefits more affordable with HDHP + HRA HSA FSA

Small employer benefits more affordable with HDHP + HRA HSA FSA

When your team is smaller than the competition, each member’s contribution must bring the most value possible to the game. That means attracting the best possible players and keeping them on the roster. One factor in the contest to recruit and retain employees is employer-sponsored group health insurance coverage and making small employer benefits affordable.

For smaller companies, the decision to provide health insurance for workers is not an easy one. This is especially true for those with fewer than 50 employees. These employers are exempt from the Affordable Care Act’s (ACA) ‘shared responsibility’ mandate. Feeling relieved in that, why would they pay for group insurance anyway?

They might do it because a recent survey shows that insurance coverage offered by the employer matters a lot to job seekers (46%) and current employees (78%).

Still, with 2017 group health coverage averaging $18,764 per employee, per year, and rising about 3% annually, knowing how much it matters doesn’t make it affordable.

Cost-saving plan designs

Fortunately, knowing how to design your group health plan can help make small employer benefits more affordable.

When it comes to choosing a group health insurance plan, employers have two options:

- A traditional PPO (Preferred Provider Organization) with lower deductibles and co-pays, and usually higher premiums, or

- An HDHP (High-Deductible Health Plan) with lower premiums and coverage levels paired with either an HRA (Health Reimbursement Arrangement) or HSA (Health Savings Account).

→ Either scenario may be enhanced with a health FSA (Flexible Spending Arrangement) by which employees can further offset out-of-pocket medical costs with tax-free dollars.

HDHP Coverage Gaps

When looking at the coverage differences between PPO and HDHP plans, the first reaction is to pick the PPO. It’s familiar and safe. Limits are clearly spelled out right there on the page.

Truth is, it is not as simple as that for most people. Many pay a higher PPO premium for coverage they never use. That means the employer is paying a higher cost than necessary, too, hampering a company’s efforts to make small employer benefits affordable.

Just like PPOs, the ACA requires that all HDHPs cover ‘preventative’ services 100%. That means an employee in good overall health that only uses insurance for an annual physical (preventative services) may not touch the deductible at all. The higher deductible of an HDHP is not a concern to this employee for the time being, but the HDHP premium savings is greatly appreciated immediately.ACA

For employees likely to experience the brunt of the higher HDHP deductibles and co-pays, there are ACA limits and rules to lessen the impact.

Along with ACA mandates on HDHP coverage, these plans must be accompanied by an HRA or HSA to further cushion out-of-pocket costs with tax-free funding.

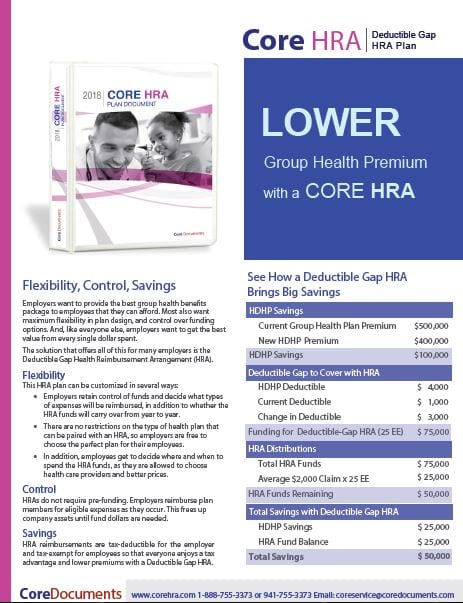

Core HRA brochure. Click to open.

HRA Example

A Deductible-Gap HRA reimburses for out-of-pocket expenses incurred within the gap resulting from the difference in deductible of the HDHP vs. a PPO. For example, if the HDHP deductible is $2,500 while the PPO deductible for the same coverage would be $500, the employer will pay up to $2,000 for an employee’s eligible medical costs falling into the gap in deductibles.

That might sound like all employer HDHP premiums savings will go back out in HRA reimbursements, which defeats the reason for having the HRA. That’s not true, however, because only employees having deductible expenses will receive reimbursement through the HRA. Unused HRA funds are not spent and retained by the company.

All HRAs are entirely employer-funded.

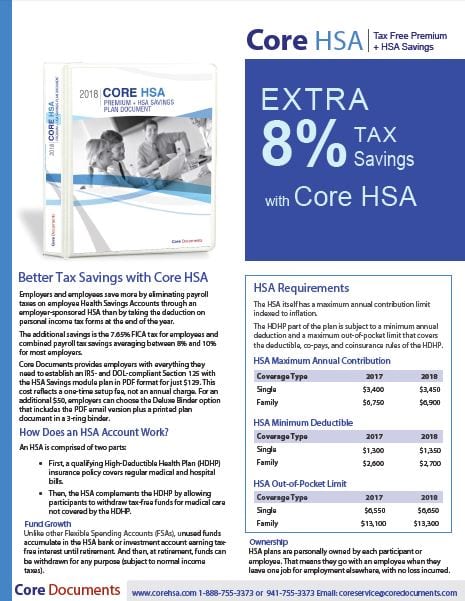

Core HSA brochure. Click to open.

HSA Example

The HSA is a pre-tax benefit designed to pay immediate medical expenses not covered by an employee’s HDHP such as deductibles and co-pays. When the account has unused funds at the end of the year, those dollars remain in the account for the next year. And the next, and the next, all the way up to retirement.

An HSA is owned by the employee. If the employee moves on to another employer at any point in time, the HSA goes with him or her. That permanence is why many financial advisors suggest using an HSA as to supplement a 401-K or other retirement fund.

To fund an HSA, the employee chooses how much will be contributed to the account via pre-tax salary deductions throughout the year up to the annual allowable limit.

Employers are not required to contribute to an HSA but many do since it helps employees with both health expenses today and retirement savings for the future.

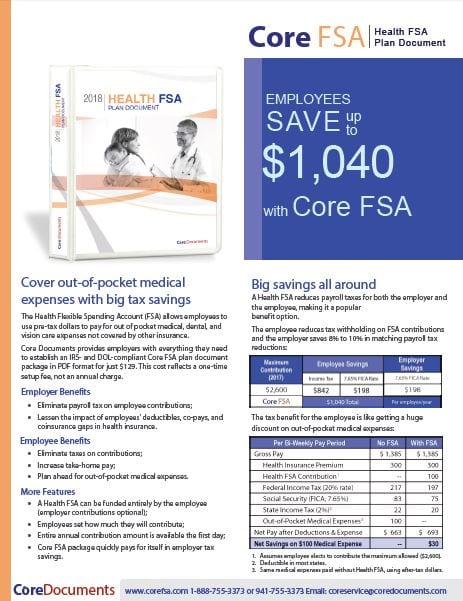

Core FSA brochure. Click to open

FSA Add-on

A health FSA can be added to both of these plans. Like the HSA, the employee elects to fund the FSA with pre-tax salary deductions (employer contributions optional) up to the IRS annual limit.

Small employer benefit options for FSA reimbursement with an HRA or HSA include the limited purpose FSA (dental and vision only) and the post-deductible FSA. Either can play a strong role in making small employer benefits affordable.

Plan Document Packages

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant HRA or Section 125 with the HSA Savings module plan in PDF format:

No annual fee — Core Documents does not require an annual renewal fee to maintain your plan document package. A plan document only needs to be updated when there are changes in the plan or in the law that make it necessary. We will notify you when there are sufficient changes in the Code to require amending and restating your Plan and ask that you keep us informed when there is a change to your plan. You can amend and update your plan document anytime, at a discounted fee and only when necessary, which is the most cost-effective way to maintain it.

Fast Service — Most orders placed by 3 PM are returned via email the same day, Monday through Friday. Weekend orders are sent out Monday morning. Plan document packages are processed in the order received. During our busiest months (December, January, and February), the rush order fee (see order form) marks your document to be processed immediately.

Refund Policy: Goods and services provided by Core Documents, Inc. are non-refundable upon receipt. Orders cancelled prior to shipping are subject to a fee to cover the cost of goods and services provided during the review, draft, and preparation of your order.

The Trusted Source of Affordable Benefit Plan Documents for over 20 Years.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.