Home / Blog / Survey: Employees care more about retirement than healthcare

Survey: Employees care more about retirement than healthcare

In 2013, 52% of employees said they were concerned about retirement security. In 2017, that number had risen by more than 50%. According to the 2017/2018 Global Benefits Attitudes Survey, today’s employees care more about retirement than healthcare benefits, with 3 out of 5 willing to forego a salary increase for the former and less than 50% for the latter. On the other hand, the survey showed a near total lack of concern for retirement in employees until their mid-30’s, when it skyrockets to being the top concern for employees by their late 40’s. What can an employer do to meet the needs of both?

Health Savings Accounts

The Health Savings Account (HSA) may be the perfect fit. Here’s why:

- The HSA is an optional benefit. Younger employees can opt out while those more concerned with retirement savings can contribute up to the annual limit with pre-tax salary deductions.

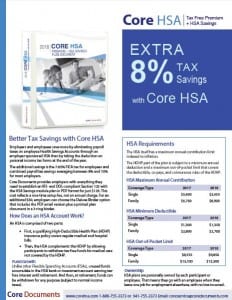

- When an HSA is offered through an employer, the employee saves even more by eliminating the 7.65% Social Security and Medicare (FICA) tax on those contributions.

- Employers also realize the FICA tax reduction. This helps employers cover administrative costs. Often, the employer saves more through elimination of FICA taxes on employee contributions than the cost of plan administration.

- An employer-sponsored HSA may be funded entirely with employee contributions. The employer is not required to add anything at all, though many do put in a small amount as a bonus retirement benefit and to encourage employee participation.

Health and retirement benefits in one plan

No doubt, you noticed that the HSA is a Health Savings Account. You may wonder how it works for retirement.

First, the HSA is a back-up account that employees can use to pay for eligible out-of-pocket medical expenses. These include co-pays, deductibles, co-insurance, and other costs not covered by the health insurance plan.

Any funds remaining in the HSA at the end of the year roll over in the account to the following year. That rollover continues year after year through retirement.

In retirement, HSA funds can be used to pay for healthcare expenses or for anything else the retiree wants or needs. They can take a vacation or buy a new car. They just need to remember that, like most other pre-tax retirement savings accounts, HSA funds used for other than health care expenses is taxed at their income tax rate in retirement.

More savings with HDHP coverage

Additional savings to both employer and employee come when the HSA is partnered with a high-deductible health plan (HDHP). That means lower premiums offset by higher out-of-pocket expenses, but the Affordable Care Act limits how high the annual out-of-pocket maximum can be. HDHP coverage is also attractive to a lot of younger employees wanting to save on health insurance costs, though they may not contribute as much to the HSA as their older counterparts.

Permanent ownership

Employees love one big difference between the HSA and other health-related flex accounts like the FSA: The employee owns the account. If she becomes separated from the employer for any reason, the HSA is hers to keep. She may add to it on her own, let the balance grow as an investment with no additional contributions, or move the fund balance to a new employer’s HSA plan.

Employer Costs

As said earlier, the employer is not required to deposit a single cent into an employee’s HSA as well as how the employer’s FICA tax savings will usually cover administrative costs. One question remaining is how much it costs to set up an employer-sponsored HSA option for employees in the first place.

The IRS and DOL only require employers to adopt a formal plan document and SPD to define the benefit design in writing. The Core HSA plan document package from Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Section 125 with the HSA Savings module plan in PDF format for just $129. This cost reflects a one-time setup fee, not an annual charge.

When an employer has as few as one employee making the maximum allowed contribution to an HSA, the FICA tax savings alone is more than $500.

Related to, “Survey: Employees care more about retirement than healthcare” —

To learn more about the Core HSA package, read these blog posts or download our brochure (in the last link):

Core HSA ordering information

Coupling High-Deductible Health Insurance with HSAs, HRAs, or FSAs

HSA Plan and Health FSA Combined – What is a Limited-Purpose FSA?

2018 HSA family contribution restored to $6,900 – IRS RP 2018-27

ACA coverage rule for dependents up to age 26

Video: