Home / Blog / What does ADP charge for a Section 125 Premium Only Plan or POP?

What does ADP charge for a Section 125 Premium Only Plan or POP?

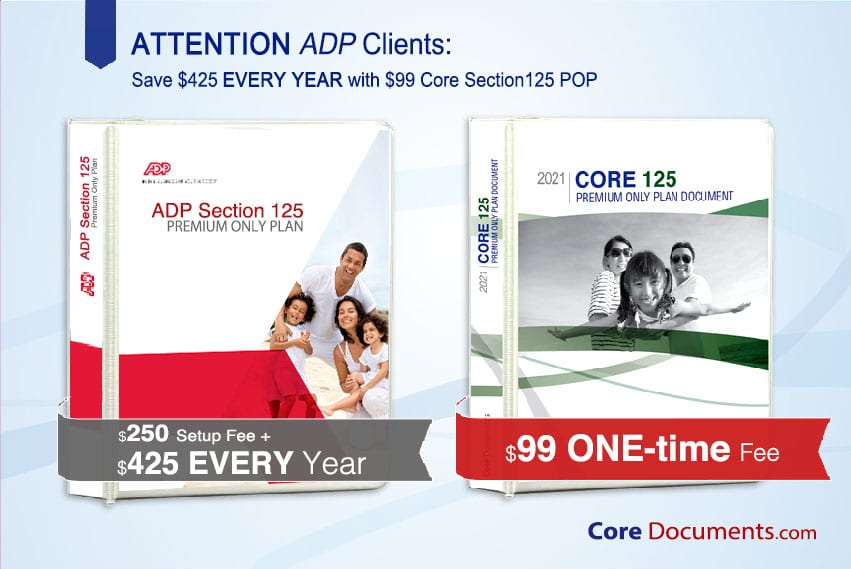

ADP payroll clients have reported paying up to $425 per year plus an initial setup fee of up to $250 for ADP Section 125 POP administration. Many ADP clients are extremely happy to learn they can save $425 every year by purchasing and administering their own Section 125 POP.

What is a Section 125 Premium Only Plan?

A Section 125 Premium Only Plan (POP) allows employees to pre-tax insurance premium such as group health and dental, vision, accident, term life insurance, disability, etc. Employees save up to 40% in payroll taxes and the employer save 7.65% in matching FICA taxes.

ADP Section 125 Fee $425 Every Year

ADP payroll clients have reported paying up to $425 per year plus an initial setup fee of up to $250 for ADP Section 125 POP administration. Many ADP clients are extremely happy to learn they can save that $425 every year by purchasing and administering their own Section 125 POP for just a $99 one-time fee*.

ADP will still deduct your employee’s qualifying group health and supplemental insurance premium. Those employee pre-tax premium deductions remain in the employer’s general asset checking account until needed to pay insurance carrier invoices.

Nothing really changes; ADP still has to designate each employee’s insurance premium deductions as “pre-tax” instead of “post-tax”, (by checking a box) in their payroll software. This is what ADP refers to as Section 125 “administration”, checking the “pre-tax” box when the original deduction is entered, plus an annual non-discrimination test when requested.

Save $425 Every Year and do your own Non-Discrimination Testing

The $99 one-time fee for the Section 125 Premium Only Plan from CoreDocuments.com comes with employer non-discrimination annual test forms. In just a few minutes any employer can conduct their own non-discrimination testing and save $425 a year.

The IRS intent behind non-discrimination testing was to keep employers from designing elaborate tax-free benefit programs for just a few highly compensated and key employees while eliminating all the lower paid employees. As long as all employees have equal access and employer contribution levels discrimination will not be an issue.

About Core Documents, Inc.

Since 1997 Core Documents has provided over 44,000 satisfied employers with everything they needed to establish IRS-, Department of Labor- (DOL), and Affordable Care Act (ACA)-compliant Section 125 benefit plan documents starting at just a $99 one-time fee*.

For an additional $50, employers can choose the Deluxe Binder option that includes the PDF email version plus a printed plan document in a 3-ring binder (shipped via USPS).

And, for just $30 more, you can add the HSA Module for additional tax savings for the employee and the employer.

This is the most affordable way to comply with the Internal Revenue Code Section 125 requirement for a written plan document and the DOL requirement to provide employees with a Summary Plan Description (SPD). All included with your $99 package with forms and an administrative guide. You also have email, fax and toll-free telephone access to professionals whenever you have questions.

* The $99 base PDF cost reflects a one-time setup fee, not an annual charge. The document only needs to be updated for just $79 when IRS, DOL & ACA law changes or once every 5 years as required by the DOL. Core Documents notifies their clients when an update is required.