Home / Blog / HRA options for health professionals: QSE-HRA, ICHRA, 1-person HRAs

HRA options for health professionals: QSE-HRA, ICHRA, 1-person HRAs

Whatever your specialty, in solo or group practice, for any number of employees and within any budget, there’s a perfect fit for you and your staff among the many HRA options for health professionals.

An HRA is a Health Reimbursement Arrangement that reimburses covered employee(s) for eligible out-of-pocket medical expenses. Some plan designs also allow reimbursement of the employee’s health insurance premium, sparing the practice from the time and expense of providing a traditional group health plan.

There are two kinds of HRAs – stand-alone and GHP-integrated.

Stand-alone HRAs do not require the employer to sponsor a group health plan. The employee selects individual or non-group health coverage (NGHP) on the open market (or ACA marketplace), pays the premium, and then submits receipts for reimbursement through the HRA.

GHP-integrated HRAs are set up to accompany a group health plan. The most popular plan design in this category is the deductible gap HRA, which works with a lower-premium high-deductible health plan (HDHP).

Both stand-alone and integrated HRAs can reimburse for eligible out-of-pocket medical expenses.

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Health Reimbursement Arrangement in an affordable, easy-to-use plan document package.

Ready to order? Each section below includes pricing information with a link to our convenient and secure order page for that plan design.

Have questions? Click the contact link to the far right in the blue menu bar at the top of this page or call us at the toll-free number above it.

Stand-alone HRAs

One-Person HRA Plan

For a practice with one employee, there is a one-person HRA that is exempt from ACA rules. The plan is also known as a Section 105 HRA, in reference to the governing Section of the IRS Code.

For a practice with one employee, there is a one-person HRA that is exempt from ACA rules. The plan is also known as a Section 105 HRA, in reference to the governing Section of the IRS Code.

Like any other HRA, the plan sponsor determines the amount available to the employee for reimbursement of health insurance premium and related medical expenses during the plan year.

Out-of-pocket expenses eligible for reimbursement with a one-employee HRA include all of those named in IRS Publication 502.

This arrangement allows the practice to provide comprehensive coverage for the employee on a pre-determined budget. It also lets an employee purchasing their own coverage to choose the NGHP that is best for them.

ACA Coverage Rules

The Affordable Care Act’s (ACA) no annual/lifetime limit and essential health benefits requirement applies to all health plans with 2 or more employees. Since this HRA covers only 1 person, it is exempt from those rules.

⇒

Core 105 plan document package just $199 (.pdf version).

Click to order.

Qualfied Small Employer HRA for > 50 employees

When a practice has more than one but fewer than 50 employees, the Qualified Small Employer HRA (QSE-HRA) is available. This plan provides assistance to employees to (1) purchase a qualifiying health coverage and (2) pay eligible out-of-pocket medical costs.

Employer Eligibility

To provide a QSE-HRA to employees:

- The practice must qualify as a small employer with fewer than 50 employees, and

- Cannot have any group health plan for any other active employees.

For example, the practice may not offer a QSE-HRA to hourly employees while providing a group health plan for salaried workers.

Coverage Amount

The employer determines the amount to provide employees for eligible medical expenses within a plan year (usually on a monthly basis), up to the IRS annual limits:

- The same amount must be provided to all employees;

- The only exception is to have one level for employees with individual coverage and another for those with family coverage.

ACA Coverage Rules

The QSE-HRA differs from the one-person HRA in that the ACA essential health benefits and no annual/lifetime limit rules do apply to the required minimum essential coverage (MEC) for plan participation.

Reimbursement

An employee must purchase MEC on the open market or ACA marketplace and provide proof of MEC before receiving reimbursement for the MEC premium or out-of-pocket medical expenses.

⇒

Core QSE-HRA plan document package just $199 (.pdf version).

Click to order.

NEW: Individual Coverage HRA for 1+ employees

The Individual Coverage HRA is a new plan model for plan years beginning January 1, 2020, and later. Like other stand-alone plans, the employer does not have to provide a traditional group health plan to employees; however, with the ICHRA, an employer may offer a traditional plan to a group of employees that is not offered participation in the HRA.

Employer Eligibility

To provide an ICHRA to employees:

- The practice must not offer a choice between the ICHRA and a group health plan to any group of employees.

For example, an employer may offer part-time employees an ICHRA while full-time employees are offered a traditional group health plan, but no group of employees may be offered a choice between an ICHRA and a traditional group health plan.

Coverage Amount

The practice determines the amount to provide employees for eligible medical expenses within a plan year (usually on a monthly basis); there is no IRS minimum or maximum limit:

- The same amount must be provided to all employees in an employee classification group;

- Exceptions can be made within an employee group for employees with dependents and for older employees.

ACA Coverage Rules

The ICHRA must integrate with individual health coverage purchased by the individual on the open market or an exchange.

Reimbursement

Employees must submit proof of individual health coverage at the start of the plan year and with each reimbursement claim.

Learn more

To learn more about this new HRA model, click here.

⇒ Core IC-HRA plan document packages will be available for just $199 beginning August 19, 2019.

HRAs for group health plans

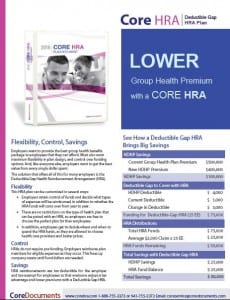

Deductible Gap Plan for 2+ employees with group health insurance

A practice can reduce the high cost of traditional GHP premiums without putting additional financial burden on employees by integrating a deductible gap HRA with a high-deductible health plan (HDHP).

A practice can reduce the high cost of traditional GHP premiums without putting additional financial burden on employees by integrating a deductible gap HRA with a high-deductible health plan (HDHP).

As its name implies, an HDHP brings with it a higher deductible than traditional health plans. Like any type of insurance, a higher plan deductible brings significantly lower premiums.

To buffer the sting of higher deductibles for employees, an employer can set up an HRA to cover the gap between the former, traditional plan deductible and the increased HDHP deductible.

For example, an HRA covering the gap between a $500 and $1,500 deductible reimburses deductible medical expenses starting at $501 and ending at $1,500 for a total of $1,000 in a plan year. The church reduces coverage costs when the $1,000 per year, per employee is lower than the premium savings.

More savings that this is realized, however, because while this coverage is available to every employee covered by the HDHP, it is only actually paid when a deductible medical expense is incurred by an employee. Most employees will have less than the original $500 in deductible expense, meaning they will not draw from the HRA at all.

Comprehensive HRA

This HRA works in tandem with traditional GHP. It usually reimburses employeses for insurance deductibles and co-pays, prescriptions, as well as dental and vision expenses. All HRA funds are tax-free to the employee.

As with all HRAs, the employer determines the amount available to employees in a plan year. It may be made available to employees in a lump sum at the start of a plan year or accrue in monthly allowances. The employer also decides if any remaining balance at the end of the year rolls over to the next and, if so, how much.

Limited HRA

The limited HRA works much like the comprehensive integrated plan with the practice also deciding to limit the type of medical expenses reimbursed through the HRA.

Popular design options limit HRA reimbursement to eligible expenses for dental care, vision care, prescriptions, select insurance premiums, or select retirement benefits.

A traditional GHP is required when an employer offers a limited HRA.

⇒

Core HRA plan document package just $199 (.pdf version).

Click to order.

NEW: Excepted Benefit HRA

New for 2020 plan years, the EBHRA is available to employers that also offer a traditional group health plan to employees whether the employee chooses to participate in the group plan or not.

New for 2020 plan years, the EBHRA is available to employers that also offer a traditional group health plan to employees whether the employee chooses to participate in the group plan or not.

Employers may offer up to $1,800 per year to reimburse employees for insurance premiums covering vision, dental, and other medical excepted benefits and related expenses.

Learn more

To learn more about this new HRA model, click here.

⇒ Core EB-HRA plan document packages will be available for just $199 beginning August 19, 2019.

For more information related to a church employee HRA, read these blog posts:

ICHRA, QSE-HRA comparison — Which is best for your practice?

QSE-HRA reimbursement to employees without health insurance

QSE-HRA: Small Employer HRA Plan Documents Just $199

Health Flex Spending Account: HSA, FSA, HRA | What’s the difference?

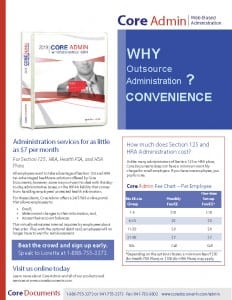

Brochures

Since 1997, Core Documents has been a leading provider of affordable plan documents required by the IRS, DOL, and ACA for tax-favored employer-sponsored benefit plans, including Section 125 Cafeteria Plans, Health Reimbursement Arrangements and associated flex benefits including the Health FSA, HSA, DCAP FSA, and Transit plans.