Home / Blog / GOP Health Plan Proposal Expands HSA Benefit

GOP Health Plan Proposal Expands HSA Benefit

In his first speech to a joint session of Congress, President Donald J. Trump called on Congress to pass an Obamacare replacement that will, “help Americans purchase their own coverage,” in part through, “expanded Health Savings Accounts.” This makes clear that whatever form the GOP health plan to replace Obamacare takes, the HSA will play a major role in its success.

The Health Savings Account (HSA) is an increasingly popular vehicle for individuals wanting greater control over their health care choices. Since enactment of the Affordable Care Act (ACA), HSA’s have grown from around $10 billion in total contributions to more than $50 billion. Those figures represent deposits from both individuals and employers, as the HSA is increasingly chosen as a benefit option among businesses seeking to provide more valuable health coverage benefits to their employees.

One reason for the popularity of the HSA in GOP health plans is its permanence and portability. An individual may first receive an HSA in an employee benefit package. If that employee becomes separated from the original employer, the HSA goes with the employee. That HSA can can accumulate tax-free interest on the existing balance as well as on additional tax-deductible contributions made throughout the years (in accordance with then-current tax law). Any withdrawals taken to cover allowable medical expenses are tax-free, too.

GOP Health Plan HSA Contributions

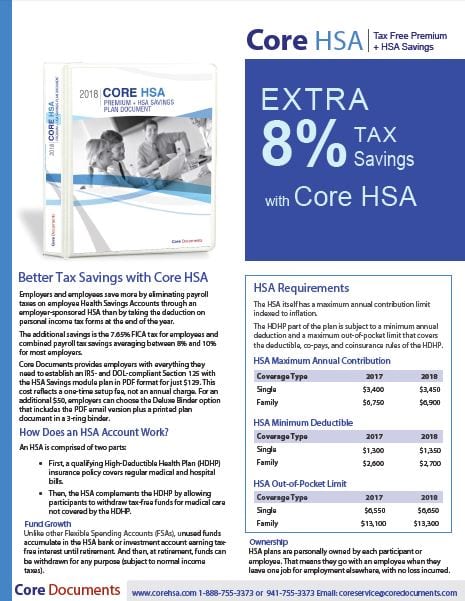

Today, the annual contribution limit for an HSA is $3,400 for an individual and $6,750 for family coverage. According to proposals in the GOP health plan, these amounts could nearly double to $6,550 and $13,100, respectively.

Those figures are not arbitrary. Currently, an HSA must be coupled with a high-deductible health plan (HDHP) with a deductible of between $1,300 and $6,550 for individuals and $2,600 and $13,100 for families. The annual contribution limit changes in the GOP health plan would allow the owner of an HSA to meet their full allowable health insurance deductible with tax-deductible contributions.

HSA Advantages

The HSA appears in GOP health plans more than other tax-deductible health spending or reimbursement plan because the HSA is permanent and portable.

To compare, FSA’s and HRA’s have some sort of use-it-or-lose it provision, depending on the employer’s benefit plan options, and neither is portable. When an employee changes jobs, these plans stay with the sponsoring employer.

To compare, FSA’s and HRA’s have some sort of use-it-or-lose it provision, depending on the employer’s benefit plan options, and neither is portable. When an employee changes jobs, these plans stay with the sponsoring employer.

There is no use-it-or-lose it provision that can be applied to the HSA. Unused dollars roll over from one year to the other. And, as mentioned earlier, if a participant in an employer-sponsored HSA leaves that company, the account goes with them.

Plus, the HSA can double as a retirement savings plan with some tax advantages over an Individual Retirement Account (IRA). All of this makes it the ideal choice for a GOP health plan aimed at returning health insurance choice to the individual in the marketplace.

GOP Repeal & Replace

For now, it looks like the GOP Congress and Administration are looking to “repeal and replace” Obamacare by Executive Order and with portions of larger bills, like the individual mandate repeal in the 2017 tax plan.

Let your Senators and your Representative know what you think about the current status of repeal and replace efforts with a phone call, letter, or email. You can find contact information for U. S. Senators (by state) here and for U. S. Representatives (by zip code) here.

Save an Extra 8% with Tax-Free Insurance Premium & HSA Savings at Work

Save an Extra 8% with Tax-Free Insurance Premium & HSA Savings at Work

$129 one-time fee in PDF via email*

$179 one-time fee in PDF email* + Deluxe Binder via USPS

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Section 125 with the HSA Savings module plan in PDF format for just $129. This cost reflects a one-time setup fee, not an annual charge.

For an additional $50, employers can choose the Deluxe Binder option that includes the PDF email version plus a printed plan document in a 3-ring binder.

For more information on the HSA, HDHP’s, and related items, read:

Coupling High-Deductible Health Insurance with HSA, HRA, or FSA plans

FSA, HSA, and HRA: What’s the difference?

High Deductible Health Plan and HSA with Section 125 Plan

HSA’s stronger financial incentives encourage engagement