Home / Blog / Health Savings Account in Section 125 Plans with High Deductible Health Plans

Health Savings Account in Section 125 Plans with High Deductible Health Plans

Small employers can maximize tax savings by adding the Health Savings Account in Section 125 Plans for employee benefits.

The following video gives a short explanation of how the HSA and HDHP work together within a Section 125 Plan. The annual contribution limits are set by the IRS to increase annually per inflation.

Health Savings Account in Section 125 Plans

An HSA is comprised of two parts. The first part is a qualifying high-deductible health plan (HDHP) insurance policy that covers regular medical and hospital bills. The second part of the HSA allows you to make tax-free contributions to an investment account, retirement account, or HSA bank account from which you can withdraw money tax-free for medical care. The Health Savings Account with high deductible health plan coverage pairing has increased in popularity as employers search for cost-effective ways to provide tax-free health benefits.

Adding the Health Savings Account to Section 125 Plan documents (along with the required HDHP coverage) increases potential savings for everyone via reduced tax liability.

Adding the Health Savings Account to Section 125 Plan documents (along with the required HDHP coverage) increases potential savings for everyone via reduced tax liability.

Tax Savings for Employees: For HSA employee participants fortunate enough to have an employer with a Section 125 Plan with the HSA module, savings average between 22% and 40%, depending on the employee’s tax bracket. The savings comes from eliminating liability for income and FICA (Medicare and Social Security) tax by using pre-tax dollars to make HSA contributions.

Tax Savings for Employers: Using the Section 125 Premium Only Plan to pre-tax HSA savings also lets the employer reduce taxes paid by avoiding matching FICA, federal unemployment (FUTA), and (generally) state unemployment taxes on these dollars. This results in tax savings on average 7 to 10 percent more than offering the same employee benefits without the Section 125 Plan with the HSA module.

Savings lost without Section 125

The additional 7.65% in FICA taxes (and additional savings for employers in unemployment tax) is only available by pre-taxing an HSA through an employer’s Section 125 Plan. This extra savings is lost to both employer and the employee if the HSA savings is just deducted from the employees gross income on IRS Form 1040.

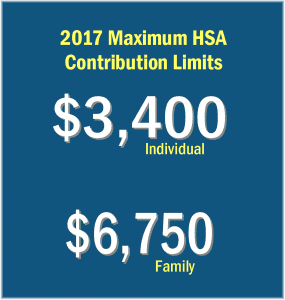

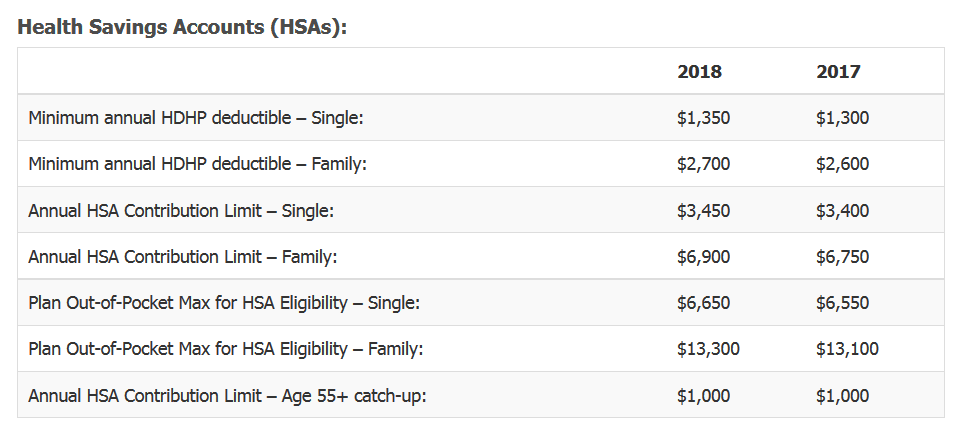

What Are the 2017 and 2018 HSA & HDHP Contribution Limits?

Related: Small Business HRA Relief becomes law – Core Documents offers package for $199

Setting Up an HSA

Employers with at least two employees can establish a Section 125 Plan with an HSA module quite simply. Basically, you need to decide the terms of the plan and put a properly prepared IRS- and DOL-required Plan document in place.

Employers with at least two employees can establish a Section 125 Plan with an HSA module quite simply. Basically, you need to decide the terms of the plan and put a properly prepared IRS- and DOL-required Plan document in place.

Since 1997, Core Documents has been the nation’s leading provider of affordable Plan documents (as required by the IRS and DOL) to thousands of satisfied agents and employer groups nationwide. Our online order form leads you through all of the terms of your plan to be certain nothing is missed.

At Core Documents, Inc., your Plan document is prepared exclusively for your Plan; it is not a run-of-the-mill template. Also, you pay only once for your Plan document whereas most other providers require an annual renewal fee whether or not any update or revision is needed.

The Section 125 POP with HSA module Plan document package from Core Documents includes:

- Resolution to Adopt,

- Plan Document,

- Summary Plan Description (SPD)

- Election Forms,

- Claim Forms, and

- Administrative Instructions.

Implementation and Administration

Once you receive your HSA Plan Document package, all you need to do is to sign as indicated (in two places), give every employee a copy of the SPD, and keep the document stored on site in case of an IRS audit or DOL inquiry. They’re fairly rare, but you only need to keep the compliant Plan Document immediately available in case it should it happen. There is no need to file the plan with any government agency.

Administration of an HSA is pretty simple, too. Funds can be held in the company’s regular account until funds distribution is requested. No separate trust account is needed. Also, amounts are not reported on employee W-2’s at the end of the year.

Order Your Plan Documents Today!

The Core Documents Section 125 Premium Only Plan with HSA package is just $129. That’s $99 for the Section 125 POP document and $30 to add the HSA module. Ordering is easy with either our online ordering or FAX order form.

The Core Documents Section 125 Premium Only Plan with HSA package is just $129. That’s $99 for the Section 125 POP document and $30 to add the HSA module. Ordering is easy with either our online ordering or FAX order form.

Click here for our FAX order form.

As always, the knowledgeable and friendly team at Core Documents is available

to assist you throughout the process:

Questions? Please Call Us Toll-Free at 1-888-755-3373

Or, email [email protected]

Refund Policy: Purchaser understands that goods and services provided by Core Documents, Inc. are non-refundable. Orders cancelled prior to shipping are subject to cancellation fees applied to the cost of goods and services provided during the review, draft, and preparation of your order.