Home / Blog / Health Insurance for S Corporation 2% Shareholders

Health Insurance for S Corporation 2% Shareholders

The cost of health insurance premiums paid by an employer is usually excluded from taxable income on the employee’s W-2. A more than 2% shareholder of an S corporation is not eligible for this exclusion.

However, with health Insurance for S Corporation 2% shareholders, the 2% shareholder may be able to deduct the cost of the premiums on his Form 1040.

What is a 2% shareholder?

A “2% shareholder” is an S corporation shareholder who owns, directly or indirectly, more than 2% of the stock of the corporation on any day during the tax year.

Indirect ownership – family attribution rules

The following family members of a shareholder are treated as owning a shareholder’s stock for this purpose:

- Spouse

- Children

- Grandchildren

- Parents

Example 1

Karen sells her entire 10% interest in Flagco (a calendar year S corporation) on January 2, 2013. She continues to work at Flagco and receives health insurance through the company. Karen is a 2% shareholder of Flagco for 2013 because she owned more than 2% of Flagco’s stock on at least one day (January 1) in 2013.

Example 2

Justin is an employee of Flagco and receives health insurance through the company. He owns no Flagco stock. However, his father Jerry owns 75% of Flagco’s stock. Justin is a 2% shareholder of Flagco because he is deemed to own 75% of Flagco’s stock through the family attribution rules.

Tax treatment by the company

Health Insurance for S Corporation 2% Shareholders: Reporting to the shareholder

The cost of health insurance premiums paid by the S corporation for a 2% shareholder is included in the shareholder’s W-2 as Box 1 taxable income. The amount is subject to federal income tax withholding. It is not subject to FICA and FUTA taxes if the payments are made under a plan for employees generally or for a class (or classes) of employees. There is no definition of a class of employees, and there is no requirement that the class not be discriminatory. A plan normally exists if any one of the following applies:

- The plan is in writing or is otherwise made known to employees,

- There is reference to the plan in the employment contract,

- Employees contribute to the plan,

- There is a separate fund for payments apart from the employer’s salary account, or

- The employer is required to make the payments.

If any one of these applies, the benefits are not subject to FICA and FUTA taxes and are not included in Box 3 or Box 5 of the W-2.

Deduction by the company

The S corporation can deduct the cost of health premiums paid for 2% shareholders on its Form 1120S income tax return. Since the premiums are treated as additional compensation to the shareholders, the deduction should be taken on page 1, Line 7 (Compensation of officers) or Line 8 (Salaries and wages). This reduces the net income (or increases the loss) which passes through to the shareholders on Schedule K-1. The deduction passes through proportionately to all owners. It cannot be specially allocated to the person who receives the income on Form W-2.

Tax treatment by the 2% shareholder

100% of the cost of health insurance premiums paid by the corporation and included in the 2% shareholder’s W-2 can be taken as an above-the-line deduction on the shareholder’s Form 1040, subject to two limitations:

- The deduction is not allowed for calendar months in which the 2% shareholder or their spouse is eligible to participate in another employer-subsidized health insurance plan.

- The deduction cannot exceed the taxpayer’s earned income derived from the trade or business that provides the health insurance plan. S corporation shareholders treat their social security wages from the S corporation as earned income for purposes of this limitation.

Example 3

Justin is a 2% shareholder of Flagco. His W-2 for 2013 shows $78,000 of Box 1 taxable income, which includes $6,000 of medical insurance premiums paid by Flagco on his behalf. Justin is not married and had no other job in 2013.

Justin is not subject to either limitation and can take an above-the-line deduction of $6,000 on his Form 1040.

Example 4

Same facts as in Example 3, except Justin is married. His spouse Jane works and was eligible to participate in her employer’s health plan for the last 6 months of the year. She declined coverage because Justin’s plan offered greater benefits.

They cannot take a deduction for the premiums paid in the last six months of the year. It doesn’t matter that Jane declined coverage through her employer. The fact that she could have taken coverage prohibits them from deducting Justin’s cost for that period.

If the premiums paid on behalf of Justin were even through the year, they can take an above-the-line deduction of $3,000 ($6,000 total cost / 12 months X 6 months) on their Form 1040.

Example 5

Jerry is a 2% shareholder of Flagco. The company paid $8,000 of health insurance premiums on his behalf in 2013. Jerry was semi-retired in 2013, and only took a salary of $500 per month ($6,000 for the year).

Jerry’s W-2 shows $14,000 ($6,000 cash wages + $8,000 health benefits) in Box 1 taxable wages, but only shows $6,000 (the cash wages) in Box 3 social security wages.

Jerry’s above-the-line deduction is limited to $6,000 (the amount of social security wages from the S corporation). He can deduct the remaining $2,000 on Schedule A of his Form 1040, but it is subject to the AGI limitation.

Example 6

Same facts as in Example 6, but Jerry receives $20,000 of business income on his Flagco Schedule K-1, and receives an additional $10,000 of wages on a W-2 from a different employer.

The results are the same as in Example 5. The limitation is based on earned income derived from the business that provides the health insurance plan. The K-1 income is not earned income. The wages from the second W-2 are not from the business that provides the health insurance plan.

Payment of premiums

Assuming other qualifications are met, premium payments are eligible if:

- The S corporation pays the health insurance premiums in the current tax year, or

- The 2% shareholder pays the premiums and furnishes proof of payment to the S corporation, after which the S corporation reimburses the 2% shareholder for the premium payments in the current tax year.

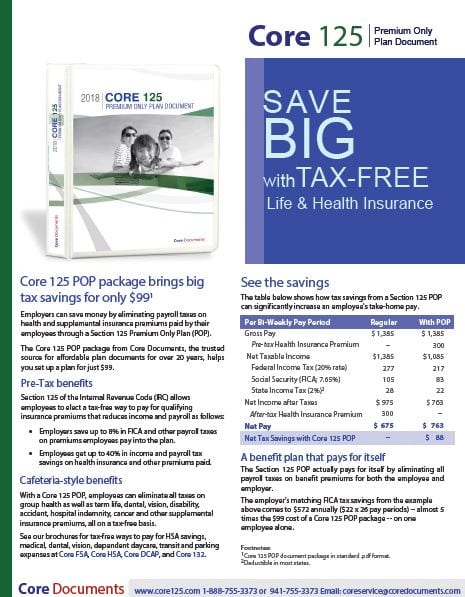

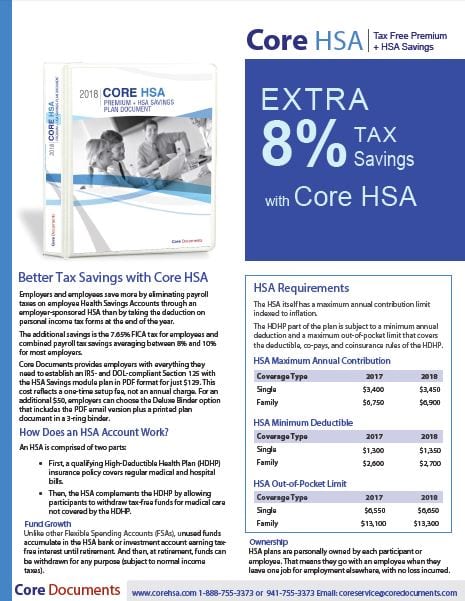

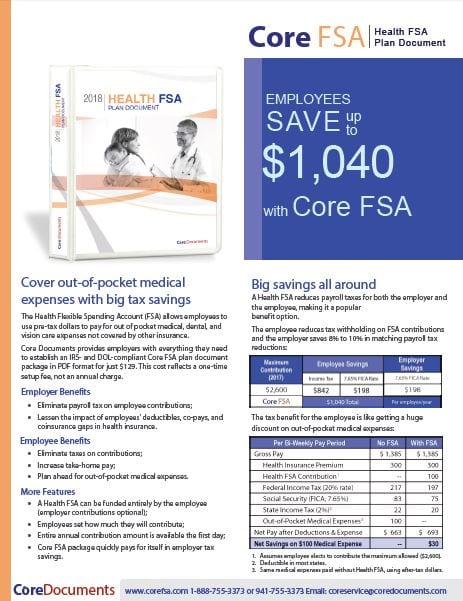

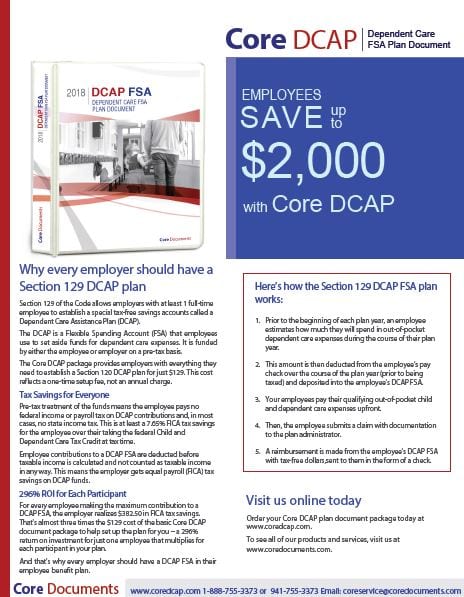

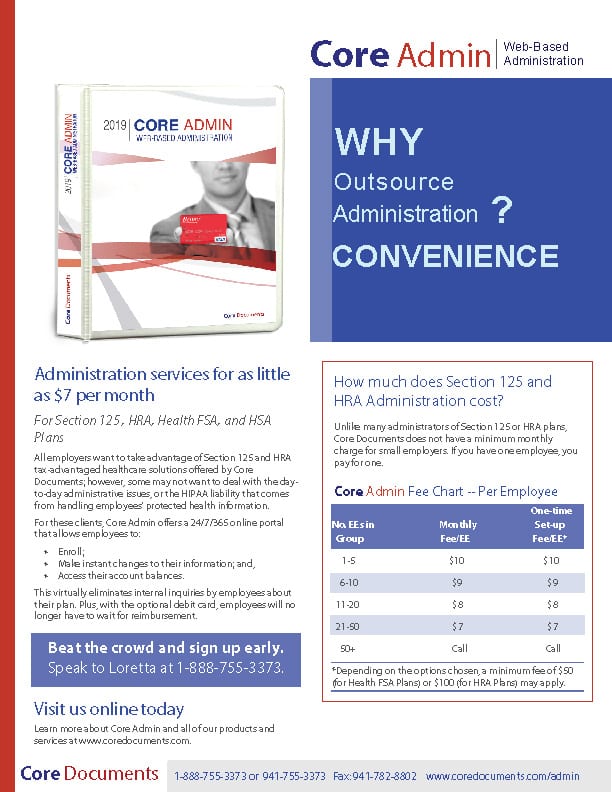

Brochures for Tax-Free Benefit Plan Documents:

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.

Click image to download.