Home / Blog / QSE-HRA employee count for eligible employers

QSE-HRA employee count for eligible employers

How to calculate QSE-HRA employee count for eligible employers

From the article, When is an employer eligible for a QSE-HRA?

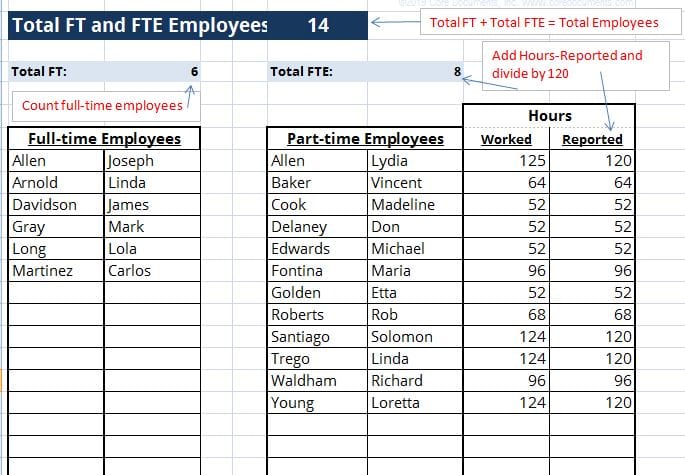

FULL-TIME EMPLOYEES

Add together the number of full-time employees (working 130+ hours) for the month.

PART-TIME (FTE) EMPLOYEES

List the hours worked for each part-time (less than 130 hours) employee in the month. Count no more than 120 hours per employee (see example, below).

Add all hours; divide by 120. This is your number of full-time equivalent (FTE) employees for the month.

TOTAL MONTH’S EMPLOYEES

Add the total FT and FTE employees. This is the month’s total employees.

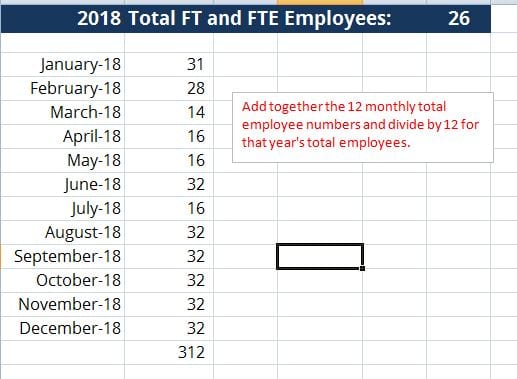

ANNUAL EMPLOYEES

Add each month’s total employees and divide that total by 12. This is the total employees for that year.

QSEHRA Plan Document Package

Our friendly and knowledgeable staff is available to

answer any questions you may have via e-mail or phone call,

Monday through Friday, 9 am to 5 pm ET:

1-888-755-3373

No annual fee — Core Documents does not require an annual renewal fee to maintain your plan document package. A plan document only needs to be updated when there are changes in the plan or in the law that make it necessary. We will notify you when there are sufficient changes in the Code to require amending and restating your Plan and ask that you keep us informed when there is a change to your plan. You can amend and update your plan document anytime, at a discounted fee and only when necessary, which is the most cost-effective way to maintain it.

*Fast Service — Most orders placed by 3 PM are returned via email the same day, Monday through Friday. Weekend orders are sent out Monday morning. Plan document packages are processed in the order received. During our busiest months (December, January, and February), the rush order fee (see order form) marks your document to be processed immediately.

Refund Policy: Goods and services provided by Core Documents, Inc. are non-refundable upon receipt. Orders cancelled prior to shipping are subject to a fee to cover the cost of goods and services provided during the review, draft, and preparation of your order.

The Trusted Source of Affordable Benefit Plan Documents for over 27 Years.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.