Home / Blog / How a $99 Section 125 plan document increases take-home pay, employer bonus

How a $99 Section 125 plan document increases take-home pay, employer bonus

Ready to order your $99 Core 125 POP document package?

Start Saving Today!

Start Saving Today!

You and your employee(s) can’t take a single cent in pre-tax benefits until the Section 125 POP document is in place with the SPD and election forms distributed to employees. That means, to make the most of the plan, you have to order your Core125 plan document package today. Click the button below for convenient and secure online ordering:

Order Online

Learn how a $99 Section 125 plan document increases

take-home pay, employer bonus tax savings

It’s no secret that health insurance premiums can be tax-deductible. What a lot of people don’t know is, getting that deduction at tax time isn’t as easy as it sounds. Here is how a simple Section 125 plan document increases take-home pay by taking full advantage of that tax deduction while giving the employer a big thank-you bonus in payroll tax savings.

Medical Expenses at Tax Time

Medical Expenses at Tax Time

While there is a tax deduction that allows people to deduct eligible medical expenses from taxable income at tax time, the key word there is ‘eligible.’ There are limits on how much of the health insurance premiums and other medical expenses paid throughout the year are eligible to be deducted from that year’s income before tax due is calculated.

First, to take any deduction for health care related expenses at all, Form 1040 (also known as, ‘the long form’) has to be filed along with Schedule A to itemize deductions. Then, only the amount of medical expenses (including health insurance premiums) exceeding 10% of Adjusted Gross Income (AGI) qualifies for the deduction.

Here’s how that works. Let’s say a couple, married filing jointly, pays a total of $7,200 as their share of health insurance premiums through an employer group plan with after-tax, take-home dollars, plus $3,000 to cover the deductible, co-pays, prescriptions, etc., during the year.

The couple has a combined gross income of $64,000 with an AGI of $58,000 after IRA contributions and other adjustments. The first $5,800 of medical costs (10% of AGI) is not tax deductible. That’s most of the entire health insurance premium.

»» Depending on the couple’s other circumstances, losing out on the tax-deductible status of that $5,800 will mean an additional $800 to $1,500 due in federal income tax alone.

Pre-tax Premiums Increase Take-home Pay

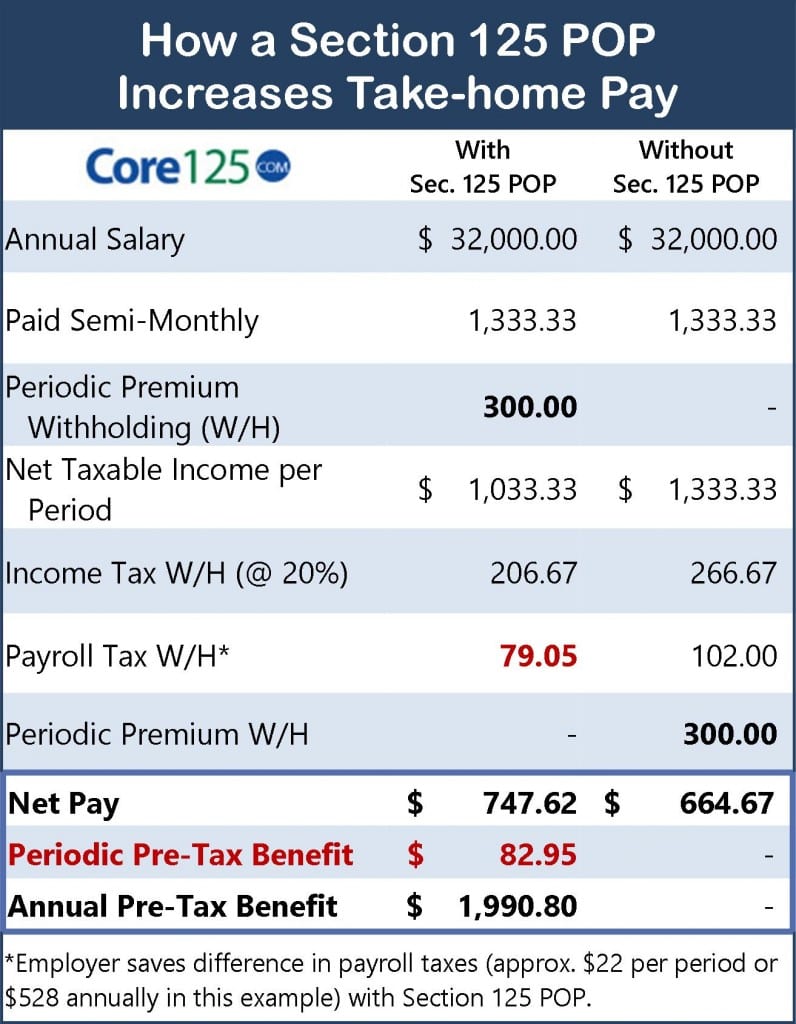

An employer can do a great deal to help this employee get the full tax benefit, and it probably won’t cost the company one red cent to do it. That’s because not only will the employee be able to fully realize the tax savings due them (resulting in an increase in take-home pay) but the employer can enjoy hundreds of dollars in tax savings per employee.

How does an employer do this? By installing a Section 125 Premium Only Plan (POP).

Under a Section 125 POP, when an employee sets aside funds to pay for health insurance premiums and supplemental benefits, those payments are deducted from salary before withholding taxes are calculated. This saves most employees between 25% and 40% in income tax (federal, state, and local in most cases) and their share of Social Security and Medicare taxes, and those savings are more real to the employee since they increase take-home pay.

Employer Pre-tax Savings

Plus, the employer is exempt from Social Security, Medicare, and payroll taxes in general on those dollars. Only employees can pre-tax premiums paid under the plan, but the payroll tax savings for the employer is significant.

Going back to our example, a company would save over $500 when that employee sets aside $7,200 into the plan to pay premiums for the year. That’s a 500% ROI on the $99 cost of the plan documents package.

Multiplied Savings

An employer can set up a Section 125 POP for a single employee, but for those with two or more on staff the savings multiply accordingly. This means potentially thousands in savings for an employer on a $99 investment.

For another $30 ($129 total), you can offer a Health Flexible Spending Account (FSA) to your employee(s). This lets them retain the tax-advantaged status of payments toward deductibles, co-pays, and prescriptions, as well as most dental and vision care expenses. An employee can set aside up to $2,600 over the course of a plan year to cover those costs with the same tax savings for both employee and employer as realized on insurance premiums paid through the plan.

Start Saving ASAP

Getting started with your new Section 125 POP is easy. First, use our secure online order form to purchase a Core125 POP plan document package for just $99 ($129 if adding the Health FSA). Core Documents, Inc., accepts all major credit and debit cards as well as e-checks.

Once your order is received, our staff will quickly prepare your custom Core125 plan document package per the information you provide us.

As soon as it is ready, your documents will arrive as a .pdf in an email (most document packages are ready within hours*). All you do is:

- Open the file, print the package, review the Plan document, and sign as indicated;

- Copy the Summary Plan Description (SPD) document with the election form, giving a copy to every employee eligible to participate in the plan; and one that is done,

- File away your Core125 plan document package with the company’s other payroll and personnel paperwork. That way you have easy access to it in the case of a new hire, a request for a copy from any employee or your accountant, and in the event of an IRS or DOL inquiry.

There is no need to file your Core125 plan document package with any agency. Also, there is no requirement of a separate banking account to establish the plan.

Order Core125 POP Today

You and your employee(s) can’t take a single cent in pre-tax benefits until the Section 125 POP document is in place with the SPD and election forms distributed. That means, to make the most of the plan, you have to order your Core125 plan document package today.

You and your employee(s) can’t take a single cent in pre-tax benefits until the Section 125 POP document is in place with the SPD and election forms distributed. That means, to make the most of the plan, you have to order your Core125 plan document package today.

Click the button below for convenient and secure online ordering:

Order Online

*As said earlier, most Core125 POP document packages go out within a matter of hours; however, keep in mind that December, January, and February are our busiest months of the year. Plan documents are processed in the order they are received. The Rush Order fee ($25, available on our order form) simply brings your document to the top of the stack to be processed immediately.

Our friendly and knowledgeable staff are available to

answer any questions you may have via e-mail or phone call,

Monday through Friday, 9 am to 5 pm ET:

1-888-755-3373

[email protected]

Refund Policy: Purchaser understands that goods and services provided by Core Documents, Inc. are non-refundable. Orders cancelled prior to shipping are subject to cancellation fees that are applied to the cost of goods and services provided during the review, draft, and preparation of your order.

Download the Core Documents Section 125 Cafeteria Plan Employer GuideHERE