Home / Blog / PCORI fee due July 31, 2020 for HRA and FSA plans -- IRS

PCORI fee due July 31, 2020 for HRA and FSA plans — IRS

Update: The Patient-Centered Outcomes Research Institute (PCORI) fee is paid by sponsors of self-insured health plans like many employer-sponsored HRAs and Health FSAs. Originally in effect for plan years ending after September 30, 2012, and before October 1, 2019, the fee has been extended through 2029.

Average lives covered (ALC) means all employees participating in the plan plus their covered dependents.

PCORI fee news

The PCORI fee was implemented through the Affordable Care Act (ACA) to help fund a trust in support of patient outcomes research. It was originally set to apply only through October 1, 2019; however, on December 20, 2019, the Further Consolidated Appropriations Act was signed into law, extending the fee through October 1, 2029.

Payment of the fee is due July 31 in the year following the plan year ending date and filed on IRS Form 720, Quarterly Federal Excise Tax Return. For plan years ending 12/31/2019, the final PCORI form will be filed by July 31, 2020.

Here’s a quick summary of IRS-announced changes for this year:

- Extending the fee to plan years ending through October 1, 2029;

- For plan years ending after October 1, 2019, and before October 1, 2020, the fee rises to $2.54 per average life covered (ALC);

- The fee remains at $2.45 per ALC for plan years ending in the prior 12-month period (October 2018 through October 2019).

HRAs and Health FSAs

Health Flexible Spending Accounts (FSA) and Health Reimbursement Arrangements (HRA) are considered self-insured health plans subject to the PCORI fee, unless they meet at least one of two exclusions:

- The plan is primarily for employees working and/or residing outside the U.S.A., or,

- The plan is considered an excepted benefit.

Your health FSA or HRA is an excepted benefit when:

-

- The health FSA sponsor/employer does not contribute more than $500 per year to the accounts and offers another medical plan with non-excepted benefits (a group health plan, for example).

- The HRA only reimburses for excepted benefits (e.g., limited-scope dental and vision expenses or long-term care coverage) and is not integrated with the group medical plan.

Sponsors of health FSAs and HRAs that do not qualify as excepted benefits are responsible for the PCORI fee.

Determining Average Lives Covered

Average lives covered (ALC) means all employees participating in the plan plus their covered family dependents.

The IRS allows three methods of determining the average lives covered during a plan year.

A sponsor may choose a different method from year to year but must stick to the same method for all counts in the same plan year.

The three methods available to sponsors of self-insured HRA or FSA health plans are:

Actual Count Method – Sponsor counts actual total lives covered on each day of the plan year, adds these daily totals together, and then divides that total by the number of days in the plan year for ALC.

Snapshot Method – Sponsor takes a ‘snapshot’ of ALC on one day per quarter. The four quarterly* measures are then added together and divided by 4 to get the average. Sponsors may use a snapshot factoring method (explained below).

Form 5500 Method – Eligible sponsors may use the number of participants from Form 5500 or Form 5500-SF.

Snapshot Method

Sponsors may use either an actual count or factoring to calculate the ALC snapshot:

Actual Count

A straight-forward method, the sponsor simply counts every life covered on a quarterly* basis, adds the quarterly totals together, and divides by 4 for that plan year’s ALC.

Factoring Count

Also on a quarterly* basis, sponsor determines how many employees have individual/self-only vs. dependent/family coverage. Each participant with individual/self-only coverage is counted as 1 life and each with dependent/family coverage is counted as 2.35 lives. The 4 quarterly totals are added together and divided by 4 to calculate ALC for the plan year.

Here’s how it works:

- On March 30, an employer has 150 eligible and participating employees. 50 of the employees have individual coverage and 100 have family coverage.

- The 100 participants with family coverage are multiplied by 2.35 for a total of 235 lives covered.

- Added to the 50 with individual coverage (235 + 50), the total ALC for this quarter is 285.

*Important: For either snapshot method, the quarterly count must take place on dates within the same 3-day period of each quarter. For example, for a calendar plan year, the quarterly count will take place on the 28th, 29th, or 30th day of March, June, September, and December.

IRS Form 720

To file and pay the PCORI fee, prepare IRS Form 720, Quarterly Federal Excise Tax Return. Mail it by the July 31, 2020, deadline with payment in full.

Don’t be intimidated by the title or the 8-page length of IRS Form 720; half is schedules not required for the PCORI fee.

To file for the PCORI fee, a sponsor fills out:

- Taxpayer information at the top of page 1,

- PCORI fee section,

- Page 3 to calculate final tax, and

- The payment voucher.

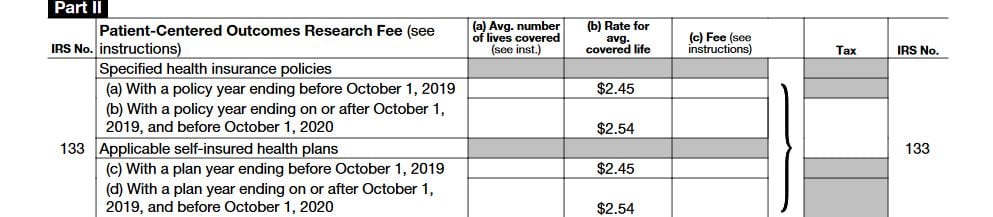

PCORI fee section

With the plan year’s ACL already calculated, completing the PCORI fee section (Section II, at the middle of page 2) is pretty simple:

- Under the “Applicable self-insured health plans” section, enter the plan year’s ACL in the first column (a).

- Multiply the ALC by the amount shown in the “Rate” column (b) for that plan year.

- Enter this amount into the “Fee” column (c).

- Carry this amount over to the “Tax” column.

- Transfer the tax to page 3, Section III, line 3 (“Total Tax”).

Here is a screenshot of Section II in the 2020 form:

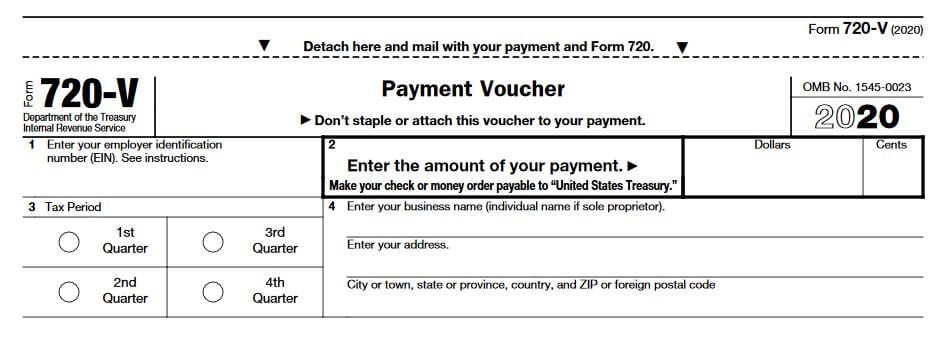

Payment voucher

Sections 1, 2, and 4 are for the usual taxpayer and payment information.

In Section 3, Tax Period, mark the voucher for the 2nd Quarter.

Disclaimer

This article is not intended as tax or legal advice. Core Documents, Inc., and its partners, do not provide tax, legal, or accounting advice. Plan sponsors must consult their own tax, legal and accounting advisors and/or the IRS web site for the best information and advice for a company’s specific situation.

The Trusted Source of Affordable Benefit Plan Documents for over 20 Years.

Core Documents is the country’s leading provider of cost-effective, tax-saving benefit plan documents for Section 125 Cafeteria plans and Health Reimbursement Arrangements. The Trusted Source since 1997, thousands of satisfied agents and employer groups nationwide rely upon Core Documents for free plan design consulting services, plan document updates, ERISA Wrap SPDs, and administration services.