Home / Blog / Employers: Update Your Section 125 Premium Only Plan by January 1, 2018

Employers: Update Your Section 125 Premium Only Plan by January 1, 2018

The IRS and the Department of Labor require employers to establish a formal plan document and summary plan description before they allow their employees to pretax insurance premium. The beginning of a new tax year is historically when most employers start a new Section 125 Premium Only Plan year. There is still plenty of time to update your Section 125 Premium Only Plan by January 1, 2018. Contact Core Documents today.

Bradenton,FL, October 21, 2017 – Section 125 Premium Only Plans allow employees to pretax or avoid paying income taxes on their portion of employer sponsored health insurance plans and some forms of non-employer-sponsored health insurance premium. January marks the beginning of a new Section 125 plan year for most employers.

Bradenton,FL, October 21, 2017 – Section 125 Premium Only Plans allow employees to pretax or avoid paying income taxes on their portion of employer sponsored health insurance plans and some forms of non-employer-sponsored health insurance premium. January marks the beginning of a new Section 125 plan year for most employers.

If your company takes advantage of Section 125 pretax deductions you might want to verify that you actually do have a current Section 125 Plan Document. It’s not unusual for employers to take Section 125 insurance pretax deductions for years without knowing that a formal plan document and summary plan description are required by the IRS and Department of Labor.

For the unfortunate employer who goes into a IRS audit without a current Section 125 plan documents the result could be reclassification of all pretax insurance deductions back to taxable income. The IRS then could assess and add interest and penalties on the unpaid taxes.

Many more employers have Section 125 Plan Documents that have never been updated. These employers are making administrative decisions based on outdated tax law and could be allowing events that would disallow their plan. If your Section 125 Plan Document hasn’t been updated since 2010 you should seriously consider updating it this January. Also, the Department of Labor requires employers to distribute new summary plan descriptions to employees once every five years.

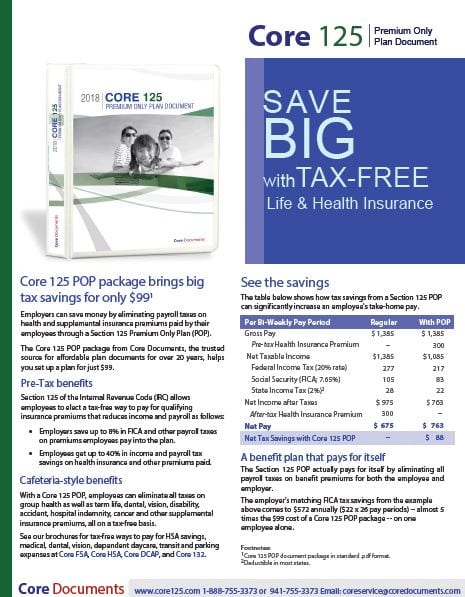

If your Section 125 Plan Document is old, outdated or missing, the New Year would be a good time to update it. How much does it cost to update or replace an old Section 125 plan? Core Documents has been helping employers amend or replace their Section 125 plan document for more than 20 years for just $99 (Basic PDF). For $149 the employer can purchase the Deluxe package consisting of a 1 inch ring-bound notebook, a Resolution to Adopt the Plan, a 29 page Plan Document, a 16 page Summary Plan Description, all new Administration and Election Forms, and a complete Administrative Guide including non-discrimination testing forms, plus the PDF version emailed as soon as the document data has been reviewed for accuracy.

How to set up a Section 125 Premium Only Plan Document

Section 125 Premium Only Plan Document

Save Big with Tax-Free Life & Health Insurance Premium at Work

$99 one-time fee in PDF via email*

$149 one-time fee in PDF email* + Deluxe Binder via USPS

Internal Revenue Service Code, Section 125, allows employees to purchase health insurance and other accompanying benefits tax-free. The Section 125 Premium Only Plan is an integral part of any small business owner’s employee benefit package.

The bottom line is employees save up to 40% in payroll taxes alone and employers save an additional 8% in matching payroll taxes on all qualifying insurance premium with the Section 125 Premium Only Plan. Employers recoup the small $99 one-time setup fee quickly and then continue to realize tax savings year after year.

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Section 125 benefits plan in PDF format for just $99. This cost reflects a one-time setup fee, not an annual charge.

For an additional $50, employers can choose the Deluxe Binder option that includes the PDF email version same day M-F*; plus a printed plan document in a 3-ring binder shipped via USPS.

For an additional $30 you can add the HSA Module to pretax HSA Savings at work for an additional 8% in tax savings for the employee and the employer.

Our secure online ordering system accepts:

Our secure online ordering system accepts:

If you prefer to order by fax, click here.

Core Documents will notify you when there are sufficient changes in the Code to require amending and restating your Plan. You can amend and update anytime for just $79, and only when necessary which is the most cost effective way to establish and maintain a Section 125 Plan.

*Most complete document orders placed by 3 PM will be emailed out the same day Monday through Friday. Orders placed on weekends are emailed out Monday morning. Keep in mind that December, January, and February are our busiest months of the year and documents are processed in the order they are received. The Rush Order fee ($25) simply brings your document to the top of the stack to be processed immediately.

Core Documents is committed to helping their clients and their employees substantially reduce their income tax liability with compliant Plan Documents that allow them to deduct insurance premiums, out-of-pocket medical expenses, dependent care expenses, and commuter and parking expenses before payroll taxes are calculated.

Visit Core Documents at https://www.coredocuments.com and discover how they can save your company more money in the coming year.

In a post-ACA health insurance America, every employer should establish a full Section 125 cafeteria plan or HRA plan to reduce benefit cost and save money.

In a post-ACA health insurance America, every employer should establish a full Section 125 cafeteria plan or HRA plan to reduce benefit cost and save money. Gene C. Ennis

Gene C. Ennis

For more information on how and why to update your Section 125 Premium Only Plan by January 1, see:

Pre-Tax Individual Health Insurance with Section 125 Premium Only Plan Document

Section 125 Plan with HSA module: Seven reasons HSAs are taking off

Helping Employers Avoid Audit Disasters for Section 125 and HRA Benefits — Core Documents Launches Campaign