Home / Section 125 Premium Only Plan (POP) Document Package - $149 one-time fee

Section 125 Premium Only Plan (POP) Document Package – $149 one-time fee

Roll over image to zoom in

Save Big with Tax-Free Group Life & Health Insurance Premiums at Work

$149 one-time fee in PDF via email*

$199 one-time fee in PDF email* + Deluxe Binder

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Section 125 plan document in PDF format for just $149. This cost reflects a one-time setup fee, not an annual charge. For an additional $50, employers can choose the Deluxe Binder option that includes the PDF email version plus a printed plan document in a 3-ring binder (shipped via USPS).

ABOUT SECTION 125 PLAN DOCUMENT PACKAGE

What is a Section 125 plan document?

Every year, Section 125 plans help both employees and employers save millions by allowing pre-tax salary deductions for health insurance premiums. Commonly referred to as premium-only or cafeteria plans, these can also encompass excepted and supplemental benefit premiums, flexible spending accounts, and health savings accounts.

These plans are beneficial, straightforward to establish, and easy to manage. The only requirement from the IRS for a tax-advantaged employer-sponsored group health and benefit plan is that the employer maintains a simple “written plan document” that is administered and kept on file.

If you sponsor a group health plan for one or more employees, and you wish to learn everything there is to know about the Section 125 plan, you’re in the right spot. For more than 27 years, Core Documents has been the top provider of cost-effective plan documents and is pleased to provide responses to your inquiries through our collection of frequently asked questions, videos, brochures, and additional resources.

Frequently Asked Questions

What is Section 125?

In U. S. Code Section 125, the Treasury (IRS) explains how a company can set up a group benefit plan that allows employees to pay premiums for health insurance, excepted benefits, and supplemental coverage with pre-tax salary deductions.

The only documentation Section 125 requires is a “written plan document.” There is no requirement to file the Section 125 plan document with any government agency. It must simply be signed and kept on file within the company.

For more on the history of Section 125, read our anniversary series: Celebrating 40 years of Section 125 Cafeteria plans.

Back to top

Do I need a Section 125 Plan Document for my business?

To pre-tax employee insurance premiums, you must have a plan document.

A Section 125 plan is defined as a “written plan” that documents the structure, rules, and sponsor information of the plan.

In other words, failure to have a plan document means there is not a compliant plan in place, and the employer’s pre-tax treatment of employee premiums violates tax law.

This requirement is often missed by employers setting up a group health plan for the first time. The insurance agent or accountant usually assumes the other takes care of it. Ultimately, it is the employer’s responsibility to make sure it is done.

Related: Do I need a Section 125 Premium Only Plan Document?

Back to top

How well do free ‘fill-in’ plan document templates work?

When you search online for, “Section 125 Plan Documents,” chances are good your search results will include web sites offering cheap or even free self-serve plan document templates.

Sounds good at first. After all, the whole point of setting up a Section 125 plan is to save money by eliminating income tax on insurance premiums. And what saves more than free?

Problem is, there is more to meeting the plan document requirement than changing the name and address on a form. Without a quick compliance review, your fill-in-the-blanks plan document may not be legally allowed to do what you intend.

To learn more about what free, one-size-fits-all plan documents can cost in the long run, read this blog post: Beware of “FREE” or self-serve Section 125 Plan Documents.

Back to top

How much do employees save?

Employees avoid paying any income tax on qualifying premiums and contributions. Instead, it is deducted before the taxes are calculated. As a result, an employee doesn’t have to make $300 in order to pay a $200 insurance premium – the tax liability is immediately eliminated.

Tax savings come from city, state, and federal income taxes (including Social Security and Medicare taxes) and can mean a savings of 23%-40% of their pre-tax premium deductions in federal income tax alone.

This means that, under a Section 125 Plan, an employee’s take-home pay is substantially increased. This helps reduce the high cost of providing health care coverage for the employee and family members.

Back to top

Does the plan bring the employer any tax breaks?

Yes. In fact, a Section 125 Plan is one of the few employee benefit plans that continually pays dividends back to the employer.

It does this by eliminating the 7.65% in employer-matching Social Security and Medicare taxes as well as some Federal and State unemployment taxes. Depending on the state, employers may also be eligible for workers compensation savings.

The bottom line is: Employers who establish a Section 125 Plan recoup the small $149 one-time set-up fee quickly and then continue to realize tax savings year after year.

Back to top

Who Can Participate in a Section 125 Plan?

Eligible employees of regular corporations, S corporations, limited liability companies (LLCs), partnerships, sole proprietorships, professional corporations, and non-profits can all reduce taxes as part of an employer’s Section 125 plan.

Employers set eligibility guidelines according to permitted employee classification rules. For example, full-time vs. part-time or seasonal.

The Internal Revenue Code prohibits a sole proprietor, partner, members of an LLC (in most cases), or individuals owning more than 2% of an S corporation from directly participating in the plan; however, owners still benefit from payroll tax savings when sponsoring a plan for their employees.

Back to top

How is a Section 125 plan a “cafeteria plan”?

The basic Section 125 Plan Document allows an employer to offer pre-tax salary deductions to employees to pay group health plan and other insurance premiums through the plan. Basic premiums beyond health insurance can include dental or vision coverage, group term life, disease-specific insurance, long-term care, and more.

However, the employee is not required to take any particular policy or benefit but may pick and choose, as you would put the items you want on your tray in a cafeteria line.

Learn which premiums can or cannot be deducted: Pre-tax eligible premiums for Section 125 plans.

Back to top

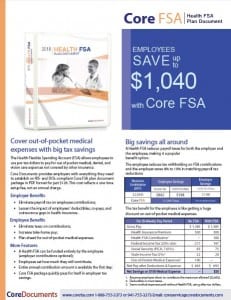

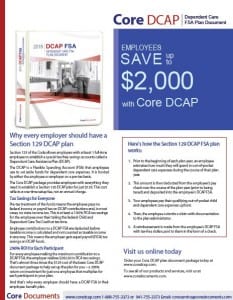

Can I add a health FSA, dependent care FSA, or Health Savings Account?

Yes. Employers can expand cafeteria-style options by adding a Health Flexible Spending Arrangement (FSA), Dependent Care Assistance Plan (DCAP) FSA, and a Health Savings Account. And, adding any or all of these to a Section 125 plan provides the same tax savings on pre-tax employee contributions as on pre-tax premiums.

Learn more: Section 125 cafeteria plan options.

Back to top

Do I have to start a Section 125 plan on January 1?

No. A Section 125 plan can start at any time of the year.

Ideally, an employer will set a plan year that coordinates with when the group health insurance plan renews (as rates typically increase then). This gives employees an opportunity to sign a new election form prior to the new Plan Year (during the open enrollment period).

When an employer wants to set a plan in place right away, a short Plan Year is used. Let’s say an employer wants a normal plan year of January 1 to December 31 but wishes to start the new plan in May of this year.

The first plan year will run May 1 to December 31; all following plan years will be January 1 to December 31.

Back to top

What comes with a comprehensive Core 125 Plan Document package?

The Core125 Plan Document package comes in .pdf format. It is emailed to you, usually within 1 business day. The Deluxe Version adds a printed version of the package in a 3-ring binder sent the same day via Priority Mail.

Every Core125 package includes the following materials, all customized for your company and plan:

- Section 125 Premium Only Plan Document

- Corporate Resolution to Adopt a Section 125 Plan

- Administrative Handbook

- Summary Plan Description (SPD)

- Premium Election Form

Deluxe Binder Edition

For a description of each item, see: Core 125 POP Plan Document package.

Back to top

How do I set up my new Section 125 plan?

No outside administrator or software is needed to implement a Section 125 plan. A one-page summary of all plan sponsor responsibilities is included in your package.

Here is a quick look at what to do when your Core125 package arrives:

- Sign the Plan Document in the two places indicated.

- Keep it on file and available in case an IRS audit, the DOL requesting a copy, an employee asking to view the document, or for your own personal administrative guidance.

- The document is not filed with the IRS, DOL, or any other government entity.

- Give eligible employee a copy of the Summary Plan Description and election form. Election forms should be signed by employees for specific approved deductions, returned to the employer, and kept on file.

- Conduct non-discrimination testing annually. Your Core125 Plan Document package includes forms to assist you in this process.

Back to top

When does a plan document need to be updated?

The plan document needs an update whenever there is a change in your plan or in tax and health care law that require it. Core Documents advises clients when there is a change in the law; you let us know of any change to your group benefit plan.

Ideally, a Section 125 plan document is renewed at least every five years.

It is not unusual for a group to lose track of a plan document and need to replace it. Contact us right away so we can help get a new plan document in place for you as soon as possible.

Back to top

Where can I order a Core 125 plan document package customized for my benefit plan?

Core Documents provides employers with everything they need to establish an IRS- and DOL-compliant Section 125 benefits plan in PDF format for just $149. This cost reflects a one-time setup fee, not an annual charge.

For more information on ordering, including a fax option, go to the Core125 package page.

Back to top

Order Your Core 125 Premium Only Plan today!

The Core 125 Plan Document Package Includes:

Summary of Plan Sponsor Responsibilities,

Resolution to Adopt the Core 125,

Core 125 Plan Document,

Employee Summary Plan Description (SPD),

Election Forms, Claim Form, Change Form and

Complete Administration Guide.

$149 one-time fee in PDF via email*

$199 one-time fee in PDF email* + Deluxe Binder

Section 125 Plan Brochures(with forms)

Core125 brochure and forms (click image to

download).

|

CoreHSA brochure and forms (click image to download).

|

CoreFSA brochure and forms (click image to

download).

|

CoreDCAP brochure and forms (click image to

download). |

Core132 brochure and forms (click image to

download). |

Cafeteria Plan Employer Guide (click image to download).

|

Contact Us

Want to make sure you’re choosing the tax-saving options best for your particular situation? Get in touch with an expert on Section 125 plan design. Send us an email or call our friendly, knowledgeable staff at 1-888-755-3373.