Home / Blog / Limits for 2018 Health Savings Accounts announced -- IRS

Limits for 2018 Health Savings Accounts announced — IRS

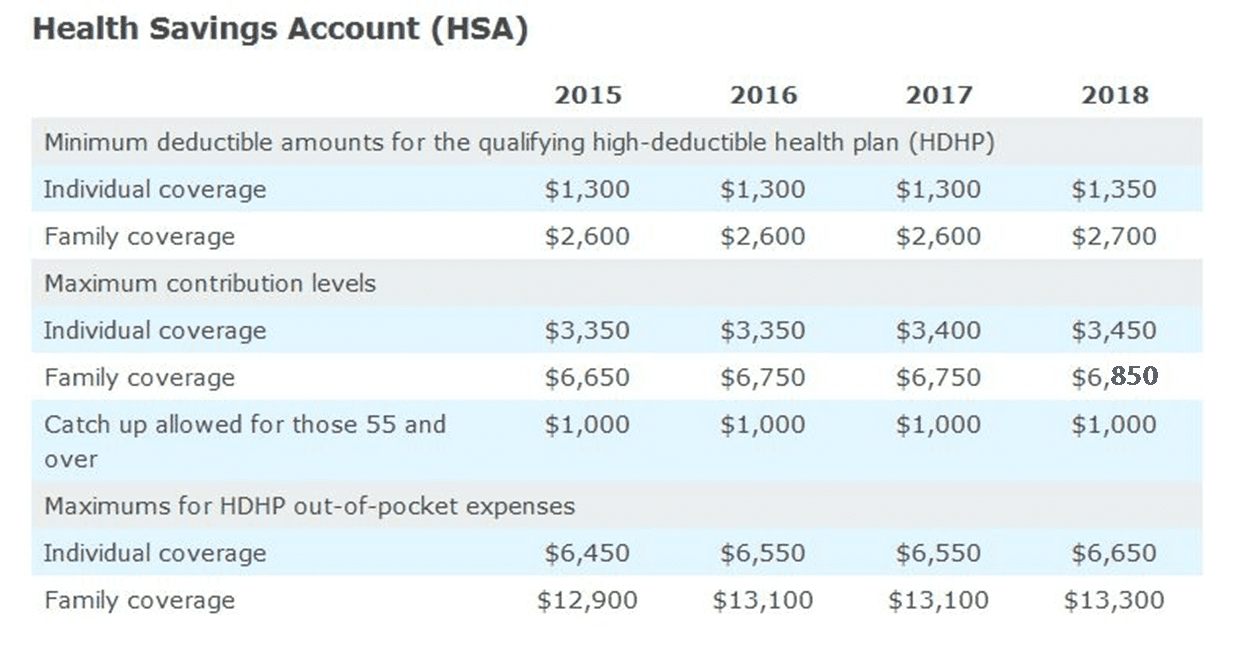

The Internal Revenue Service (IRS) has announced (via Rev. Proc. 2017-37) that contribution, minimum deductible, and out-of-pocket limits for 2018 Health Savings Accounts (HSAs) in 2018 will increase. These amounts are subject to an inflation-based adjustment each year.

IRS-approved limits for 2018 Health Savings Accounts

The 2018 HSA annual contribution limit for individuals rises from $3,400 in 2017 to $3,450 for 2018. For families, the 2018 annual contribution limit is $6,850*, up from $6,750 in 2017. All contributions to an HSA are tax-deductible and can be pre-taxed under an employer’s Section 125 Cafeteria Plan.

*The 2018 annual contribution for employees with families was reduced to $6,850 in March 2018. See our post, IRB 2018-10 Lowers HSA Family Contribution Limit for 2018, for more information.

*The 2018 annual contribution for employees with families was reduced to $6,850 in March 2018. See our post, IRB 2018-10 Lowers HSA Family Contribution Limit for 2018, for more information.

The minimum deductible allowed in high-deductible health plans (HDHPs) will also increase. For 2018, the deductible for an HDHP must be at least $1,350 for individual coverage (from $1,300 in 2017) and $2,700 for family coverage (from $2,600 in 2017). All HSAs must be accompanied by an HDHP in order to be in compliance with the Affordable Care Act (ACA).

The out-of-pocket maximum is the total dollar amount that can be left to be paid by the insured under the HDHP. This also increases in 2018 to $6,650 for individuals (from $6,550 in 2017) and $13,300 for families (from $13,100 in 2017). Out-of-pocket costs can include the deductible, co-pays, and other health care expenses, but not the premium for the HDHP.

The annual catch-up contribution amount allowed for those 55 or older by the end of a plan year is the lone exception from the increases as it does not adjust for inflation. This maximum amount remains at $1,000.

Possible changes under the AHCA

These are the limits set by the IRS in accordance with current law under the ACA, also known as Obamacare. There could be dramatic changes with health care reform. The 2017 American Health Care Act (AHCA) that passed GOP-led House of Representatives would have increased HSA contribution limits to cover the maximum allowable deductible and out-of-pocket limits now standing. It would have nearly doubled the current contributions for both individuals and families.

Although this bill failed to make it through the Senate, the increased dependence upon HSAs to expand health care choice and affordability is likely to remain. This ensures that the HSA will continue to be one of the best choices for individuals and families to use in meeting their health coverage needs while taking the fullest advantage of tax savings available.

For more information on HSAs and related topics, please see:

Coupling High-Deductible Health Insurance with HSA, HRA, or FSA plans

FSA, HSA, and HRA: What’s the difference?

Why should an Employer provide HSA Administration to their Employees through CoreAdmin?

HSA nondiscrimination testing vs. comparability rule depends on employer contribution method