Home / Blog / HSAs benefit small business employers: In the news

HSAs benefit small business employers: In the news

The Health Savings Account (HSA) plays a big part in returning health care choice to the consumer. It’s been reported on as a must-have financial tool for health care expenses today and planning for retirement. Read on to learn how HSAs benefit small business employers for added tax savings as well as competing in 2018’s tightening labor market.

In 2017, Health Savings Accounts (HSAs) began making big news in just about any report on GOP efforts to repeal and replace the Affordable Care Act (ACA), popularly known as ObamaCare. Soon, the financial press began touting the benefits of the accounts.

Here are a handful of recent items from the increased HSA news coverage:

How a Health Savings Account Could Save You Money (NBCNews, 2017)

Trump Calls For Expanding Health Savings Accounts; A Golf Driver On Uncle Sam’s Dime? (Forbes, 2017)

People don’t take full advantage of Health Savings Account (Bloomberg, 2017)

Health Savings Accounts for Everyone (WSJ, 2018)

Gen X’s Ultimate Slacker Retirement Strategy (Forbes, 2018)

Maxed out your 401(k) plan? Here’s another way to save (CNBC, 2018)

Affordable employee retention tool

HSAs benefit small business employers looking to find and keep the best employees possible. That’s because because it is affordable to the employer, employees love it, and it is easy to set up the HSA plan for employees within a company’s new or existing Section 125 Cafeteria plan. Even employers of fewer than 50 employees (and therefore not under the current ACA health insurance mandate) find that the HSA is a cost-effective way to build a strong benefits package that will attract and retain the best people.

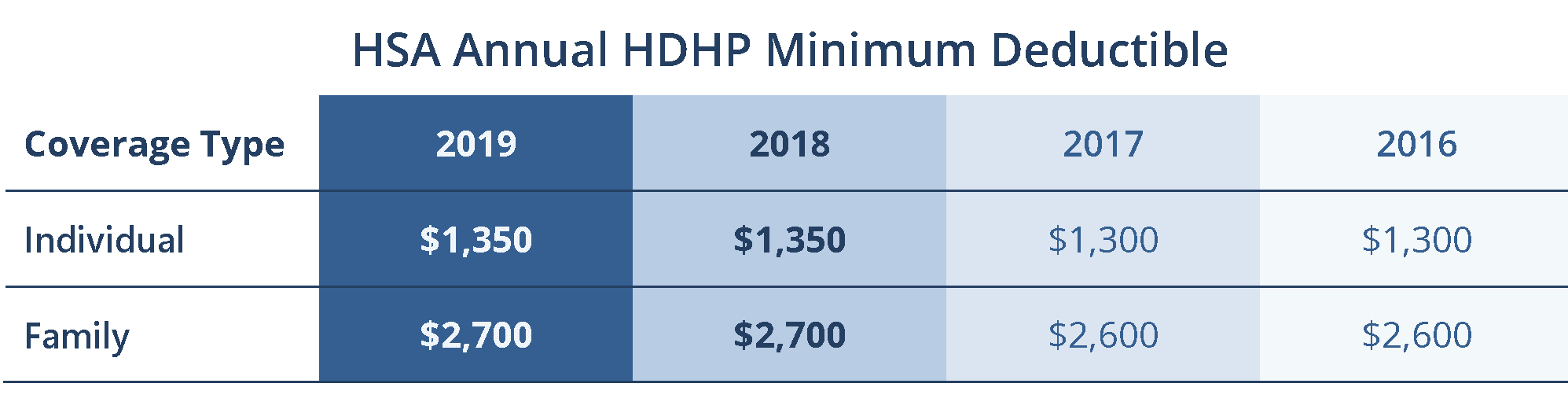

It works out this way because the HSA is offered as part of a Section 125 Cafeteria Plan. Section 125 is the part of the Internal Revenue Code (IRC) that allows employers to offer a tax-advantaged way for employees to pay health insurance premiums. With the HSA Module added to a Section 125 Cafeteria Plan, a high-deductible health plan (HDHP) with significantly lower monthly premiums is sufficient to meet the ACA mandate.

HSA advantages

When it comes to flexible benefit payment options, the Section 125 HSA has several advantages over similar plans like the Health Flexible Spending Account (FSA) and Health Reimbursement Arrangement (HRA). These include:

No use-it-or-lose-it date on contributions or fund balance;

No use-it-or-lose-it date on contributions or fund balance;- Employers may choose whether or not to add funds;

- All deposits to an HSA are income tax-free for the employee and the employer;

- When the HSA is part of an employer-sponsored Section 125 Plan, both also avoid Social Security tax on contributions — an additional 7.65% tax savings;

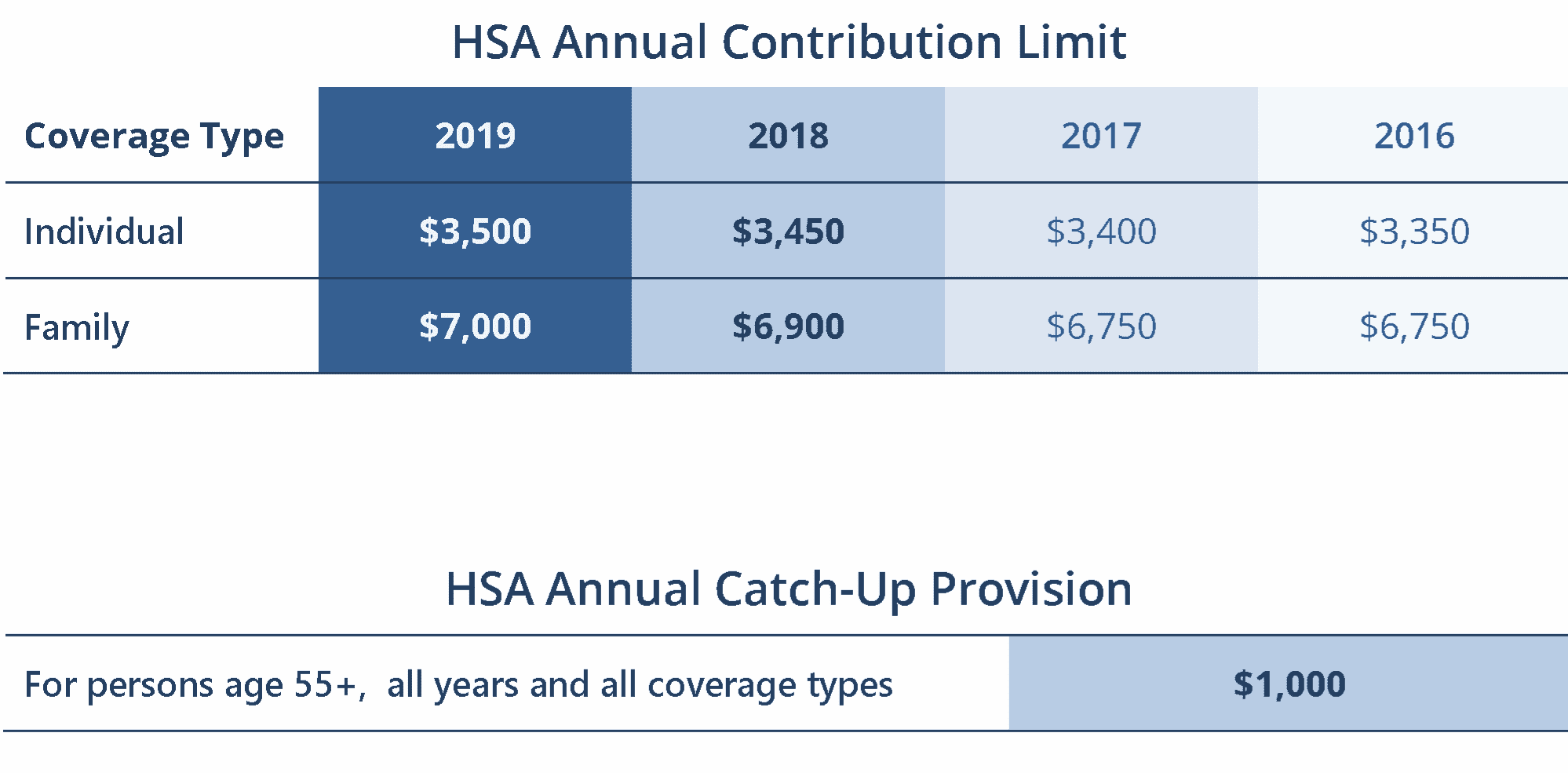

- Employees and employers can contribute up to a total of $3,450 (individual plans) or $6,900 (family plans) in 2018, with increases to $3,500 and $7,000, respectively, in 2019;

- Employees nearing retirement can use the catch-up provision to add extra funds ($1,000 annually);

- Fund balance builds to retirement; and,

- Since the employee owns the HSA, it has portability features similar to an employer-sponsored IRA or 401K account.

An excellent small business benefit choice that’s easy and economical

Not only do HSAs benefit small business employers, it is a benefits option your employees will love, and setting up an HSA option for employees is easy.

Not only do HSAs benefit small business employers, it is a benefits option your employees will love, and setting up an HSA option for employees is easy.

The first step is ordering your HSA/Section 125 Plan Document package from Core Documents, Inc.

Your CoreHSA .pdf package will arrive quickly. Upon receipt, you complete three simple steps:

(1) Sign the Plan Document,

(2) Distribute copies of the plan to employees as required, and

(3) Keep the package on file for future reference.

Perhaps best of all, it’s an economical choice for your business — the CoreHSA Plan Document Package is only $129.

To order the $129 HSA Plan Document Package* from Core Documents, Inc.,

As always, the knowledgeable and friendly team at Core Documents is available to assist you throughout the process:

We also have a fill-in FAX/email order form (.pdf). Click here to open/download.

Video:

Learn more about how HSAs benefit small business employers:

*Refund Policy: Purchaser understands that goods and services provided by Core Documents, Inc. are non-refundable. Orders cancelled prior to shipping are subject to cancellation fees applied to the cost of goods and services provided during the review, draft, and preparation of your order.